Recently, a shitcoin protocol emerged using the Bitcoin network structure, called Runes. This protocol was launched together with the fourth halving, which took place on April 19.

This time, the miner reward was reduced from 6.25 to 3.125 bitcoin per block. Many people were surprised by the block that marked the halving, number 840,000 as the miner’s revenue was 40 bitcoin!

This high reward consisted of approximately 3 bitcoins in block subsidy and another 37 bitcoins in fees alone! So the question arises: how did the miner receive so much in fees?

This happened because many people paid high fees to have their transactions included in this block, a historic block. But it was not just that! This high amount of fees was also due to the activation of the Runes protocol, which started together with the Bitcoin halving.

Runes allows the creation of fungible tokens on Bitcoin, which raises concerns among Bitcoiners that shitcoins will emerge on the Bitcoin network.

Therefore, in this article, we will understand what the Runes protocol is, how it works, and what its implications are for Bitcoin.

Table of Contents

The beginning of it all: Segwit and Taproot

Before we understand what Runes is, we need to understand how the Bitcoin network became capable of supporting this type of protocol. It all started with the Segregated Witness (SegWit) implementation activated in 2017, which separated signature data from transaction outputs, allowing for more transactions per block. This freed up space for more advanced scripts.

Five years later, in 2021, the Taproot update was implemented and was the main update to Bitcoin since the implementation of SegWit. Taproot emerged as a way to increase network security and scalability. This protocol introduces a new signature format, in which data is aggregated as if it were a single signature, taking up less space in the block, which increases speed and reduces transaction fees.

When we carry out a transaction on the Bitcoin blockchain, all public transaction data is available, such as information about how many signatures it used (singlesig or multisig) or whether there was a time lock (hash lock). With Taproot, all this information is hidden and condensed into a single signature, increasing the privacy of multisig transactions. In other words, more complex transactions, such as opening Lightning channels, appear as a conventional transaction (singlesig).

Taproot implementations introduced Bitcoin’s ability to execute smart contracts. These contracts can be made “without compromising the network”, because Taproot hides the information and makes every transaction look the same as a conventional transaction.

The Tapscript function, introduced by Taproot, improves Bitcoin’s scripting capabilities by introducing new opcodes and improving the flexibility and efficiency of network-scripts. This facilitated the creation of more complex “smart contracts” and opened the door to the Ordinals and BRC-20 tokens.

The Birth of Ordinals

Before Runes, the Ordinal and BRC-20 protocols also came.

Ordinal is a protocol that emerged in early 2023 and was created by Casey Rodamor (the co-creator of Runes). The idea of this protocol is to allow inscriptions to be made on individual satoshis.

1 bitcoin is equal to 100,000,000 satoshis; thus, Ordinal allows the individual identification of each satoshi involved in a transaction. Therefore, in a transaction, satoshis with special information may be present, making them “rare”.

Ordinal protocol works based on Ordinal Theory, which creates a type of “serial number”, called ordinal numbers, and serves to identify satoshis by the order in which they were mined or transacted. For example, a satoshi that is part of the first wave of mining that occurred in the genesis block is considered really special.

The inscriptions linked to satoshis through Ordinals are types of NFTs that use the Bitcoin network to create the records. The difference is that there is no creation of tokens but inscriptions that link photos, videos, and documents, among others to the specific satoshi.

Unlike NFTs on networks like Ethereum, which create tokens, Ordinal inscriptions are made using arbitrary data recordings. The degree of rarity does not depend on the quality of the recorded image, but on the rarity of the satoshi used to make the record.

Tokens BRC-20

The implementation of Ordinals opened doors for the creation of BRC-20 (Bitcoin Request for Comment 20) tokens on the Bitcoin network.

But, what are BRC-20 Tokens?

BRC-20 Tokens are similar to Ethereum’s ERC-20 Tokens, allowing the creation of new currencies within Bitcoin. These tokens are created by inscribing JSON files into individual satoshis using Ordinal technology.

JSON ( JavaScript Object Notation ) is a file format that uses only text, simplifying the registration process, which makes it less complex than creating a smart contract specifically for a token, as occurs in Ethereum.

However, the big problem with BRC-20 Tokens is that they require a series of transactions to be registered on the network, which results in several unnecessary UTXOs and can congest the network or increase the weight of the blocks.

To deploy (upload a coin on the Bitcoin network) a BRC-20 token, 2 transactions are required. To mint (issue/register) the token, 2 more transactions are necessary, and for the transfer, 3 more transactions.

So, as an alternative to this protocol, the Runes project was created.

What is the Runes protocol?

The Runes protocol, or runes, is basically an “improved” BRC-20. With it, it will be possible to create other tokens inscribed in Bitcoin, but this time with fewer transactions involved.

For this protocol, two transactions will be necessary to deploy the token: one to mint and another to transfer. This practically halves the number of transactions and also reduces the load on the network.

Furthermore, Runes can be integrated with the Lightning Network, enabling the creation of the token on the main network and, subsequently, its trading on the Lightning Network.

In theory, this protocol could bring new currencies to Bitcoin that would have some usability for users interested in carrying out financial operations supported by Bitcoin, such as stablecoins, governance tokens, or securities tokens.

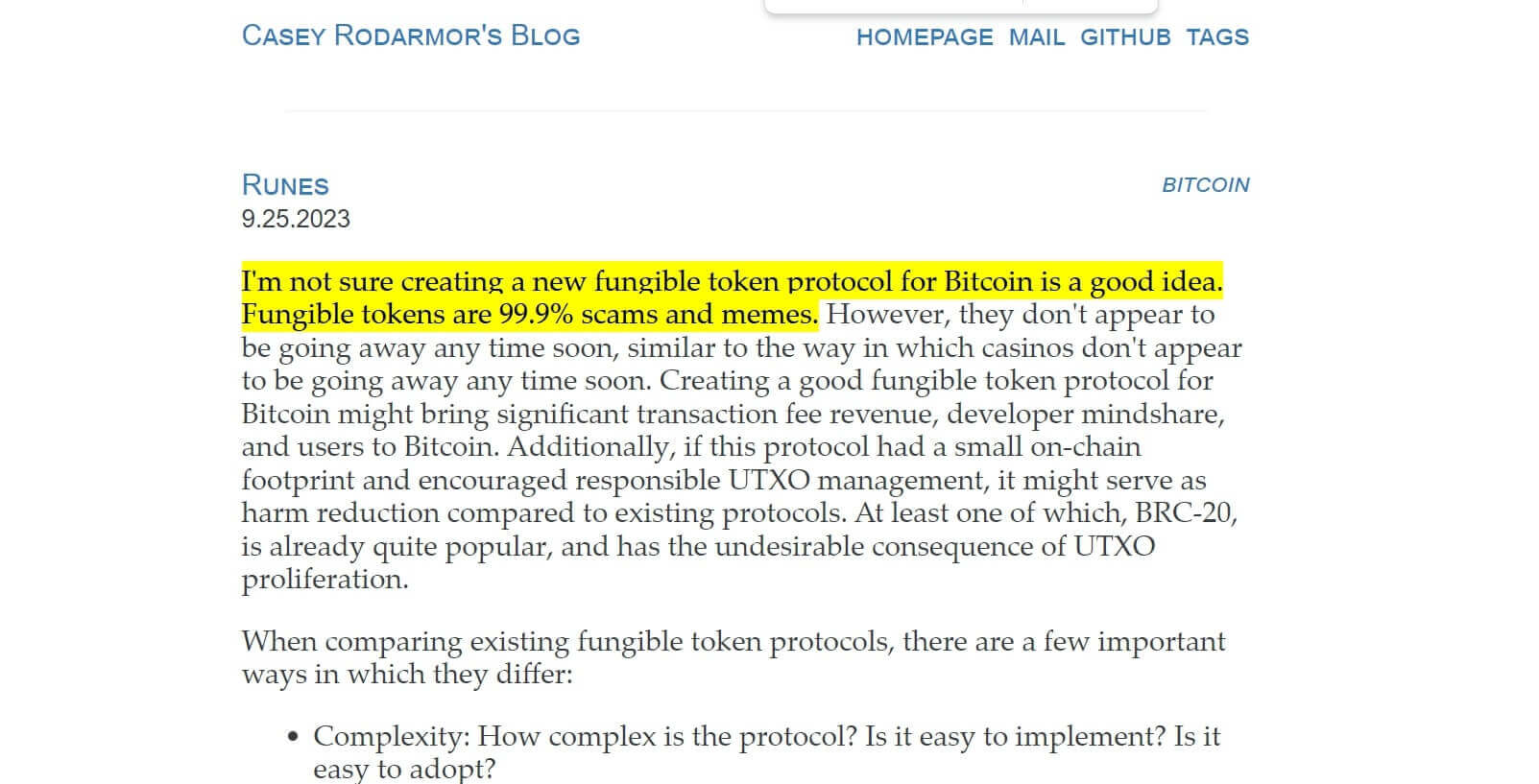

But, in practice, what we see — at least at the beginning of the protocol — is the creation of shitcoins on the network, which are mainly used for speculation and scams. The creator of the protocol himself recognized this when he published the project proposal on his blog.

How does Runes work?

Runes works in a similar way to BRC-20, which uses Bitcoin’s UTXOs and writes JSON information to specific satoshis but does not necessarily require the use of the Ordinal protocol.

Runes is based on UTXOs (unspent transaction outputs), which means that any UTXO can contain data that represents not only the amount of unspent bitcoin but also the number of runes, which can be several in just one UTXO.

Rune information is inserted into a UTXO using the OP-RETURN space, which is a way of including some arbitrary data along with a Bitcoin transaction. The OP-RETURN space basically serves as a space to “write a message” in the transaction, so it could indicate something like: “This transaction contains 20 runes”.

Since the first Bitcoin, the genesis block mined by Satoshi, Bitcoin has allowed OP-RETURN messages.

How did Runes come about?

The idea for Runes emerged in September 2023, when the creator, Casey Rodarmor, posted on his blog the proposal to create a protocol for registering fungible assets in Bitcoin. Therefore, Runes is an alternative to the BRC-20 protocol, which has some implications.

Casey’s goal with this protocol is to reduce the number of UTXOs that are generated to create a token on the network after the implementation of BRC-20, which creates many “junk” UTXOs.

Furthermore, BRC-20 needs Ordinal Theory to work, but Runes does not.

Casey acknowledges that most fungible tokens are memes or scams, but believes that creating a protocol for enrolling these tokens in Bitcoin could benefit the network and create a safer environment for them to emerge.

For him, the creation of a good fungible token protocol for Bitcoin can generate significant revenue from transaction fees, in addition to attracting greater participation from developers and users to the Bitcoin platform.

This could also encourage responsible management of UTXOs and serve as a harm reduction measure compared to other existing protocols.

What are the advantages of the Runes protocol?

There is a very pertinent discussion regarding Runes, as this protocol can bring “shitcoins” to Bitcoin and make the main network (on-chain) unfeasible to use for small transactions if it accelerates the rise in rates.

However, so far, the only positive point about Runes is that it increases incentives for miners. We know that miners receive rewards from block subsidies and also from transaction fees.

High transaction fees may be a problem for some users, but for miners, they represent an increase in revenue, an incentive to continue mining. Runes, however scammy it may be, can contribute to maintaining Bitcoin’s much-attacked “security budget”.

And what are the disadvantages of Runes?

The biggest disadvantage here is, without a doubt, Runes’ ability to bring shitcoins to Bitcoin, that is, memecoins and highly speculative currencies without any basis. These applications will greatly increase affinity scams, confusing users about what Bitcoin actually is and what is just a shitcoin made to take money from the most inexperienced or greedy users.

Furthermore, network congestion due to high fees can harm some users, who are unable to transact within the chain or are forced to pay exorbitant fees to do so.

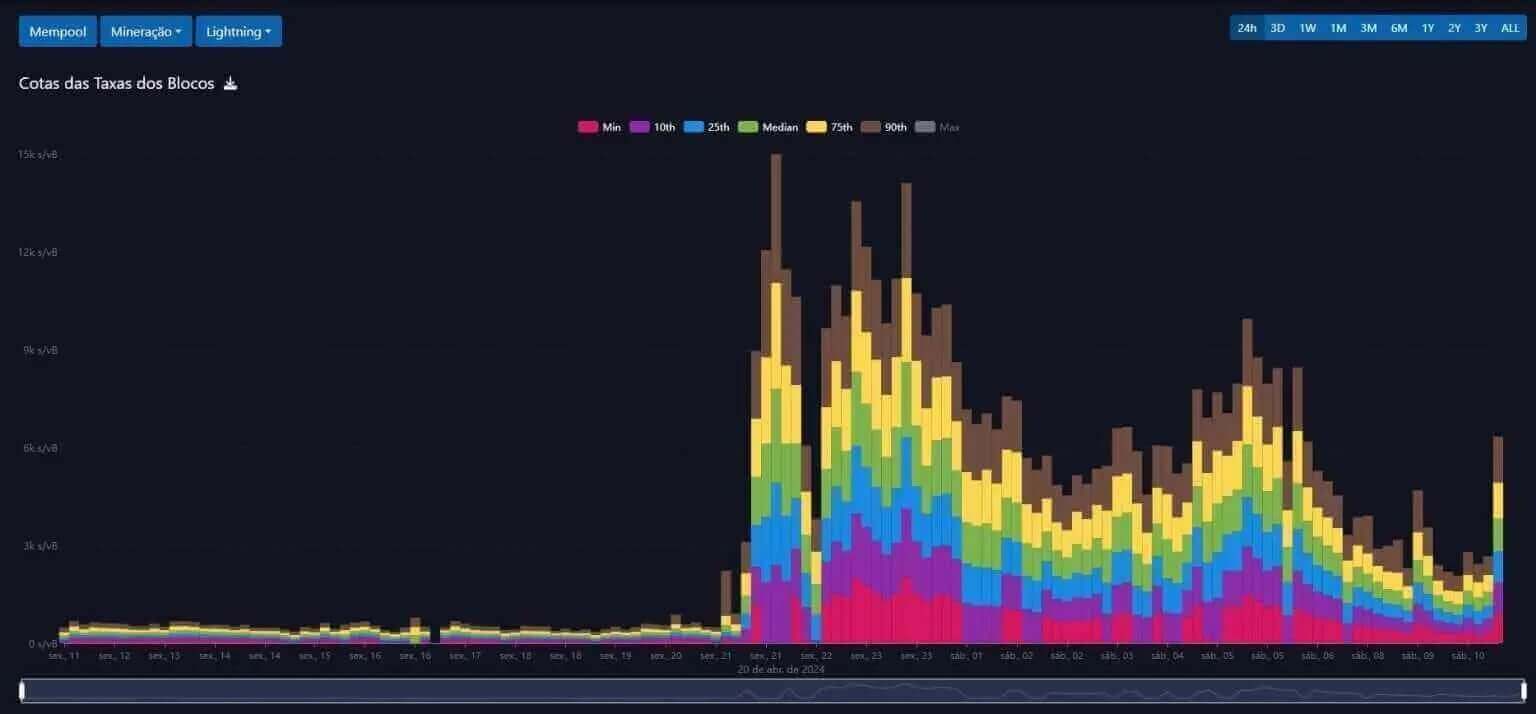

After all, network fees increased considerably right after the halving, which was when the Runes protocol was activated.

As you can see above, simple transactions cost around $200 to be added to a block. This makes ordinary users who want to use the main network unfeasible; on the other hand, it encourages users to use the second layers of Bitcoin for smaller transactions, such as the Lightning network, where it is possible to send satoshis instantly and at negligible fees.

Another problem that the Runes protocol can cause is the appearance of scammers or lay people trying to surf the hype of the movement, but who don’t know how the process works and could lose their money.

And this has already happened…

In this series of screenshots, Bitcoin developer Francis Pouliot shows some people who lost money with Runes.

One of them even lost US$5,000 trying to mint a rune…

The Runes project ecosystem

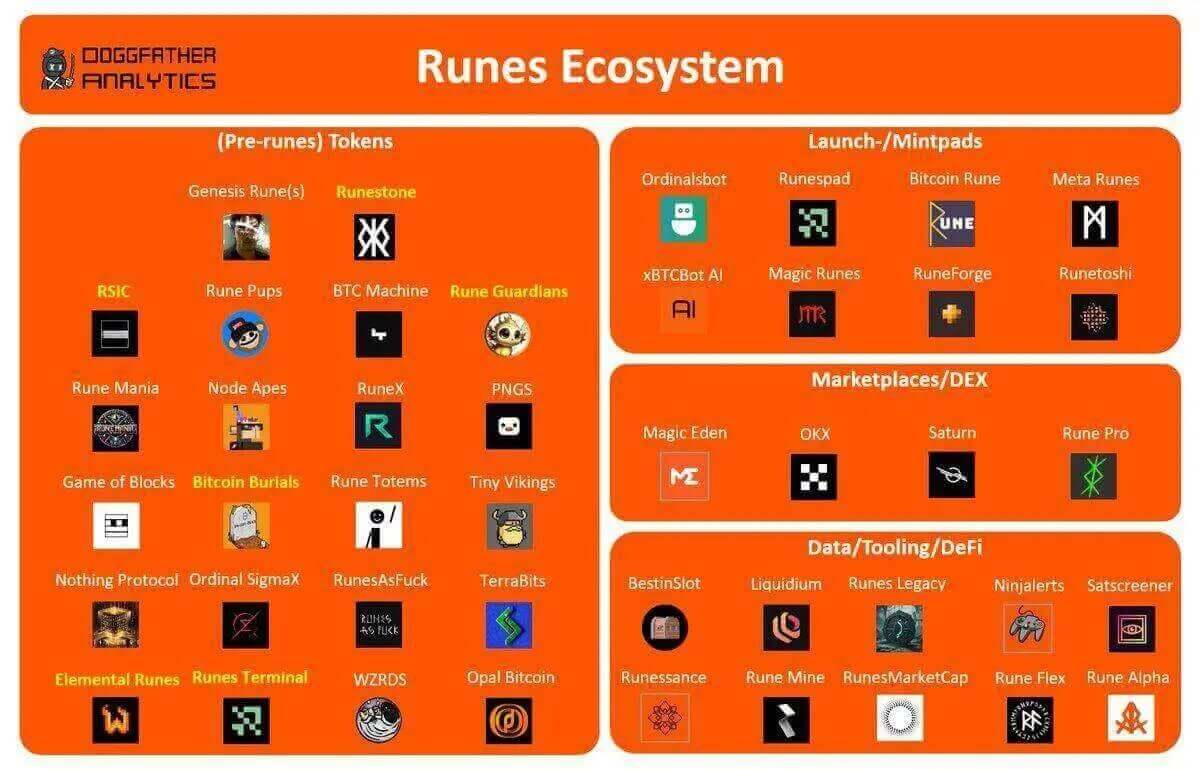

There are already some projects running with Runes, many of which are called “ pre-runes ”, as they were already active before the protocol was implemented on the network.

- Rune Coin: a project to mine Rune tokens

- Pups Token: these are a type of Rune “puppy” coins.

- Runes Terminal: a set of tools for using Runes, including an explorer and a token launch pad.

- Runessance: lending platform, where you can use your tokens within UTXOs for loans with BTC.

- RunePro: a community that offers rewards for the first members (what does that remind you of?).

- Runeflex: a DeFi application for the Runes protocol.

Conclusion

Runes are still something new in Bitcoin; We don’t know which way this project could go, but, like Ordinals, it won’t go away too soon.

It is important to understand the implications that this protocol can have on the network, especially in increasing fees for users who still mostly use the on-chain layer for everyday transactions.

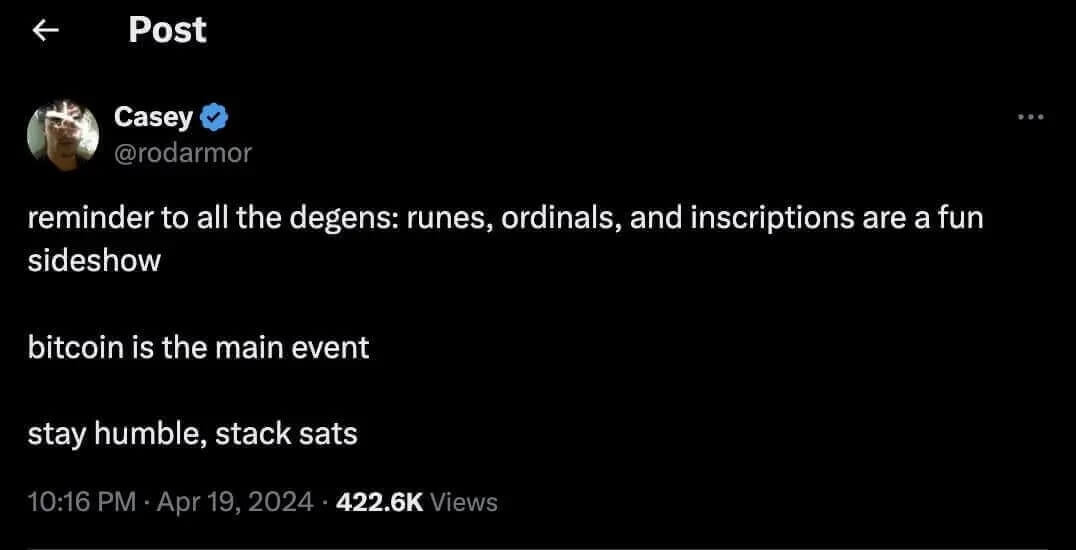

It is worth remembering that Runes, Ordinal, and BRC-20 are not part of the Bitcoin network consensus, they are a separate protocol. The fundamentals of Bitcoin do not change at all. Fees should be the main incentive for people not to use scarce block space with shitcoin.

Runes is not very different from other token projects that already exist on the market; Most of them have no foundation, they move in waves of hype and collapse and many people end up losing more than gaining with these shitcoins.

The useful life of these projects is very low, and many of them are scams (Rug Pull) to enrich the founders. Therefore, it is important to be careful with any new project that emerges, even if it “runs on Bitcoin”.

So, as the project’s creator himself said, Runes is “a fun show,” but Bitcoin is the main event.

That said, stay humble and accumulate real satoshis.

Until the next article and opt out!

Share on your social networks:

One of the leading Bitcoin educators in Brazil and the founder of Area Bitcoin, one of the largest Bitcoin schools in the world. She has participated in Bitcoin and Lightning developer seminars by Chaincode (NY) and is a regular speaker at Bitcoin conferences around the world, including Adopting Bitcoin, Satsconf, Bitcoin Atlantis, Surfin Bitcoin, and more.

Did you like this article? Consider buying us a cup of coffee so that we can keep writing new content! ☕