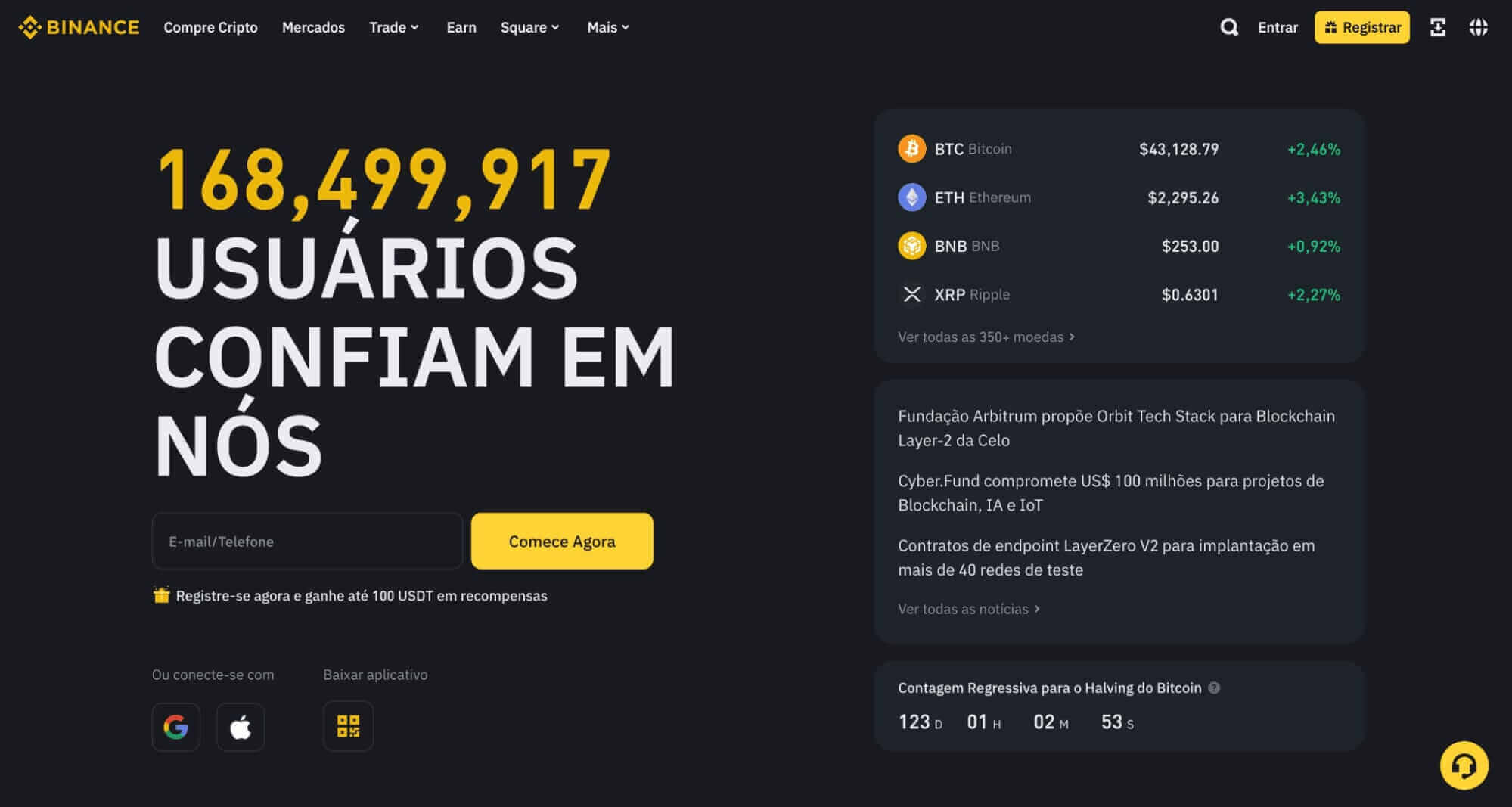

The story of Binance, which would become the world’s largest Bitcoin and digital currency exchange, began in 2017. Its journey is marked by frequent clashes with regulatory bodies, the promotion of questionable cryptocurrencies, shifting headquarters, iconic CEOs, and billion-dollar fines. This saga could easily make for a gripping streaming series.

As of now, Binance operates in over 180 countries and accepts 15 fiat currencies, including the Brazilian real, the US dollar, and the euro.

However, in November 2023, the narrative took a dramatic turn toward crime when Changpeng Zhao, the then-CEO, faced allegations from the American federal government. Accusations included money laundering, sanctions violations, and a series of tax offenses that led to his arrest, subsequent bail posting, and a record US fine of $4 billion.

So, grab your popcorn and prepare to delve into the tumultuous history of Binance. Learn how it transitioned from a “shitcoin” casino to a regulated bank through what some call regulatory capture, and discover whether Binance is a reliable platform for purchasing Bitcoin.

How did Binance come about?

The story of Binance began in China in 2017 when Changpeng Zhao, known globally as CZ—a developer with extensive experience in finance and technology—founded the platform.

Zhao conceived the idea for Binance upon recognizing the need for a more efficient Bitcoin and cryptocurrency trading platform. Prior to establishing Binance, he was part of the team that developed Blockchain.info and also served as the CTO at OKCoin, another digital currency exchange.

Initially based in China, the exchange quickly relocated its servers and headquarters to a confidential location in Japan due to a ban on trading digital currencies imposed by the Chinese government.

By April 2018, just eight months after its inception, Binance had already made a significant mark on the market. It had introduced its own currency, BNB, and achieved a record global daily trading volume of US$24 billion.

As the exchange expanded, the need to move its headquarters became more pronounced due to increasing regulations in the countries where it operated. The plan to establish a new base in Malta was announced in 2018, driven by tightening government regulations.

That year, Binance also signed a Memorandum of Understanding (MoU) with the government of Bermuda and a similar agreement with the Malta Stock Exchange.

The expansion into Europe continued with the establishment of a headquarters in Jersey—a tax haven under the British Crown but not part of the United Kingdom.

How did Binance become the largest exchange in the world?

One key factor to consider is that Binance began operating during a critical moment in the market, coinciding with the altcoin boom.

Binance capitalized on this opportunity, leveraging assets created from strategies like pre-mining and pump-and-dump schemes. It quickly became the platform with the largest altcoin listings in the market, drawing speculators from around the globe.

From the outset, the platform was geared towards speculation, trading, futures, leverage, and various strategies to “maximize profit.” Binance has also consistently offered competitive fees, maintained lower than those of other exchanges, and engaged with its user base through giveaways and community initiatives, like the Binance Angels.

With substantial financial resources and by navigating around regulations in several countries, the company adeptly rode the market waves. It expanded its offerings to include “decentralized finance” (DeFi—though this is debatable 😂), initial coin offerings (ICOs 🤮), and even launched a highly centralized blockchain, the Binance Chain, which concentrates decision-making power within the company.

Additionally, Binance acquired companies and data aggregators, such as the CoinmarketCap website and the Trust Wallet digital wallet, seeking to be present in the market’s main access, trading, and information points.

This strategy has attracted thousands of customers around the world, and Binance currently serves more than 167 million users on its platform. However, this also gave the exchange a lot of power, attracting the attention of banks and fiat institutions.

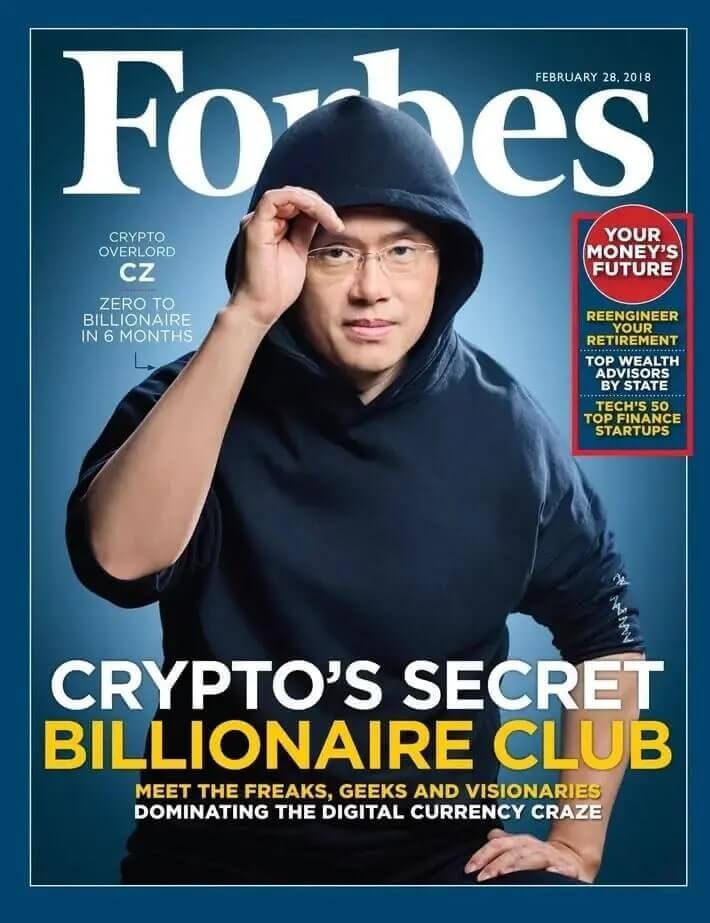

CZ and Forbes

CZ achieved a prominent position on the Forbes billionaires list and even graced the cover of the magazine in 2018. He entered the top 20 richest people in the world, with a fortune estimated at around $65 billion.

Interestingly, years later, Binance became one of the main shareholders of Forbes, having invested $200 million in the American publisher with the goal of using the media as a channel to demystify blockchain technology and emerging digital assets.

In other words, they acquired one of the largest media outlets in the world, much like banks do, to promote tokens and create biased narratives in the market—similar to their acquisition of Coinmarketcap.

The Rise of Binance US

Until 2019, Binance was not authorized to operate in the United States. However, this changed when the company committed to adhering to the stringent requirements set by US regulators, ensuring a “safe and reliable” operation for Americans.

Consequently, Binance US, a version of the global platform, was specifically created to cater to the US market. This operation, managed by BAM Trading Services Inc., based in San Francisco, launched in September 2019.

Catherine Coley

BAM Trading Services has appointed Catherine Coley as CEO, who previously held an executive role at Ripple. Her primary responsibility was to launch and expand Binance.US in North America.

Before venturing into the digital currency market, Coley worked as a foreign exchange analyst at Morgan Stanley in Hong Kong and London. Later, she served as a foreign exchange advisor at Silicon Valley Bank from 2016 to 2017.

Indeed, a remarkable fiat resume!

Interestingly, her tenure at Binance was short-lived. Catherine Coley held her position for less than a year and departed without leaving any clues as to why.

To this day, her departure remains shrouded in mystery. What could have motivated Catherine to leave one of the most coveted positions in the US at that time?

Did she uncover something that could jeopardize her reputation and personal integrity? We may never know. However, subsequent events might offer some clues.

American government on Binance’s trail

In 2020, the US Department of Justice and the Securities and Exchange Commission (SEC) initiated an investigation into Binance and its American affiliate, Binance.US.

The goal was to evaluate the extent of Binance’s control over Binance.US, particularly concerning access to US customer data. The investigation involved the issuance of subpoenas and included statements from informed individuals. This could lead to regulatory actions against the exchange if it was found to have full control over its US operations.

Regulatory scrutiny of Binance intensified following the collapse of the FTX exchange, which was the second largest in the world at the time, in November 2022.

The FTX fall

The downfall of FTX, founded by the now-incarcerated Sam Bankman, began with media reports that the young ex-billionaire had used clients’ funds to support his own investment fund, Alameda Research.

Fearing the loss of their investments, clients of the brokerage rushed to withdraw their money. However, lacking sufficient dollars to cover all the withdrawals, FTX declared bankruptcy and filed for judicial recovery.

FTX’s bankruptcy left Bankman-Fried, who once amassed a fortune of $26 billion, penniless. He was found guilty on all seven charges against him. The trial, lasting a month, not only led to substantial financial losses but also resulted in the founder receiving a prison sentence of over 100 years.

This incident raised concerns that Binance might be engaged in similar practices and could face the same fate.

At that time, there was a widespread panic, with customers rushing to withdraw Bitcoin and altcoins from various exchanges, fearing a domino effect in the market.

On Binance alone, customers withdrew R$60 billion following the collapse of FTX.

Historic fine

In 2023, the US Treasury intensified its scrutiny of Binance transactions, levying even more severe accusations against the exchange.

According to US Treasury Secretary Janet Yellen, “Binance neglected its legal responsibilities in the pursuit of profit. Its intentional oversights enabled money to flow to terrorists, criminals, and child abusers via its platform,” as detailed in The Wall Street Journal.

Consequently, a settlement reached between Binance, CZ, the US Department of Justice, the US Treasury Department, and the Commodity Futures Trading Commission (CFTC) culminated in a fine of $4 billion, according to reports from the American newspaper, concluding the investigation against the company.

The charges included:

- Money laundering,

- Bank fraud

- and transaction violations.

This fine was the highest in US history.

CZ steps down as CEO of Binance

On November 21, 2023, Changpeng Zhao (CZ), the CEO and founder of Binance, stepped down from his position at the company after posting bail and paying a billion-dollar fine. Richard Teng, who previously managed Binance’s operations in regional markets, succeeded him as CEO.

CZ announced on his social media that he would remain available for consultations with the team as necessary and in accordance with the framework established by US regulatory agencies.

The fraud allegations and accusations of terrorist financing and other crimes have not proven any misuse of customer funds by Binance, but they have certainly damaged its reputation as the “good guy” among brokers.

Is Binance trustworthy?

Binance is considered trustworthy as it is one of the largest cryptocurrency exchanges in the world and has been established in the market for several years. However, it is advisable never to leave your bitcoins on any exchange!

Despite Binance’s apparent reliability and established market presence, in this sector, nothing is too big to be immune to problems.

Who could have predicted that FTX, valued at approximately $32 billion and the second-largest exchange at the time, would go bankrupt in just two days?

It’s important to remember that exchanges serve as intermediaries and should only be used as such. They are platforms that facilitate Bitcoin transactions, but you should never leave your Bitcoin in their custody or that of any third party, regardless of how secure these platforms may appear.

Exchanges may intentionally restrict withdrawals, are vulnerable to hacker attacks, and can go bankrupt due to poor management, or worse, be run by fraudsters and scammers who might execute a “rug pull” and vanish with your bitcoins.

The key takeaway is that while these platforms are viable for purchasing Bitcoins, you should never store your Bitcoins in the custody of exchanges. Always buy and promptly transfer your Bitcoins to your own cold wallet, maintaining personal custody of your assets.

Is it worth buying Bitcoin on Binance?

Yes, buying Bitcoin on Binance poses no issues. However, it is crucial that you transfer your coins to your own custodial wallet, such as Jade Wallet.

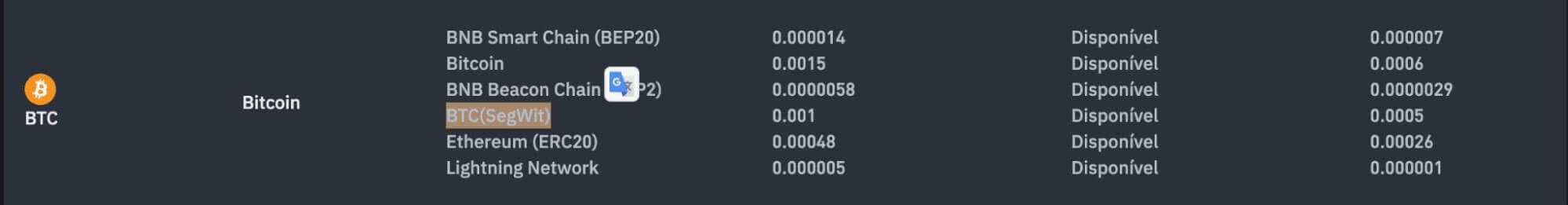

The fee to withdraw Bitcoin from Binance to another external wallet is 0.0005 BTC, which amounts to approximately R$100 based on the current Bitcoin price of $40,000. This rate is considered mid-range compared to other platforms.

It’s worth noting that Binance supports withdrawals via the Lightning Network, which incurs negligible fees. However, using this option requires a deeper understanding of transactions on Bitcoin’s layer 2.

Additionally, it’s important to remember that the Lightning Network is not ideal for storing large amounts for long-term purposes; it is better suited for day-to-day transactions. Thus, exercise caution when selecting your Bitcoin withdrawal method on Binance.

Conclusion

Binance’s rise as a platform that facilitates speculation through “shitcoins”, casino-like behavior, and the promotion of various “pump n’ dump” schemes, coupled with its evasion of country regulations, has rapidly propelled the company’s growth on a global scale.

For instance, in Brazil, Binance has not reported customer transactions to the IRS, even though national brokers are mandated to do so. This non-compliance has long made Binance a favorite among many users.

However, the same characteristics that allowed the brokerage to stand out in the global market have also made it a target, particularly drawing scrutiny from regulatory bodies in the United States.

Regulatory capture and future

The future of Binance remains uncertain, as regulatory capture has been a long-anticipated scenario by Bitcoiners. This scenario is now intensifying, with banks aiming to transform into exchanges and exchanges facing pressures to morph into banks.

The institutionalization of cryptocurrencies underscores the significance of open-source platforms and genuine decentralization—not merely as a marketing tool but as a means to withstand attacks from the traditional financial system.

Binance tried to please Greeks and Trojans, regulators and users, it sought to remain outside the fiat system but was unsuccessful. His trajectory is proof that governments will use their weapons, such as regulations, violence, and fear marketing, to maintain the fiat status quo.

This scenario will intensify more and more, especially with technologies like Bitcoin, which represent a threat to fiat structures, gaining increasing adoption and social validation.

What we can conclude is that the downfall of Binance marks the end of an era. It signifies the end of the period in which governments viewed Bitcoin as trivial, ushering in the phase of active confrontation.

Companies will face regulatory capture, decentralized protocols will be challenged, and self-custody will become essential for preserving generational wealth for you and your family.

Do your self-custody!

While exchanges like Binance may seem trustworthy and offer convenient services, nothing compares to the assurance of knowing that your bitcoins are secure in your own possession, unaffected by external actions.

Therefore, safeguard your keys and prioritize self-custody!

Until next time and opt out!

Share on your social networks:

Founder of Area Bitcoin, one of the largest Bitcoin education projects in the world, she is a marketer, passionate about technology, and a full-time hands-on professional. She has participated in major Bitcoin conferences such as Adopting Bitcoin, Satsconf, Surfin Bitcoin, and Bitcoin Conference.

Did you like this article? Consider buying us a cup of coffee so that we can keep writing new content! ☕