Positioning itself as a third-generation protocol and an alternative to proof-of-work (PoW) blockchains, Cardano claims to be more energy-efficient and more scalable than Bitcoin. However, in practice, this claim is just pure fugazzi.

All content in this article is for informational purposes only and does not consider or address any individual circumstances, and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial, or other advice. regulatory.

Cardano is named after Italian Renaissance mathematician Gerolamo Cardano, and its native currency, ADA, is named after Ada Lovelace, a 19th-century mathematician recognized for writing the first computational algorithm.

As a blockchain protocol, Cardano seeks to create decentralized solutions through automated contracts, decentralized applications, and a multichain structure. Supported by the pillars of scalability, interoperability, and sustainability, it was founded in 2015 and launched in 2017, using its programming language, Plutus.

Positioning itself as a third-generation protocol and an alternative to proof-of-work (PoW) blockchains, Cardano claims to be more energy efficient than Bitcoin and more scalable than Ethereum.

However, in practice, we observe that Cardano has not evolved even half as far as the protocols it claims to surpass. Don’t worry. we will cover all these aspects throughout the article.

Table of Contents

History

Cardano’s history has roots in the founding of Ethereum. Charles Hoskinson, on the right in the image below, was one of the founders of the second protocol in market capitalization today. Hoskinson had divergent ideas from the Ethereum team. Vitalik, left in the photo, sought a non-profit Ethereum, while Hoskinson wanted commercial goals. These differences led Charles to leave the Ethereum team and create his own protocol: Cardano.

Interestingly, Cardano does not have a published white paper, being developed through academic reviews known as peer-reviewing. Hoskinson describes this method as based on “true science” which is not true. After all, who defines what “true science” is?

In such a new market, there are no researchers experienced enough to be considered masters of reason. Cypherpunks, the fathers of cryptography, did not emerge from universities, but rather from email lists. Many protocols have anonymous developers reviewing the code, and that doesn’t make them any less qualified than academics.

As for Cardano, research papers on the protocol are published and guide decisions and updates. However, these papers are supported by IOHK, Input Output, Cardano’s founding company, which raises concerns about publication bias in favor of its own solutions.

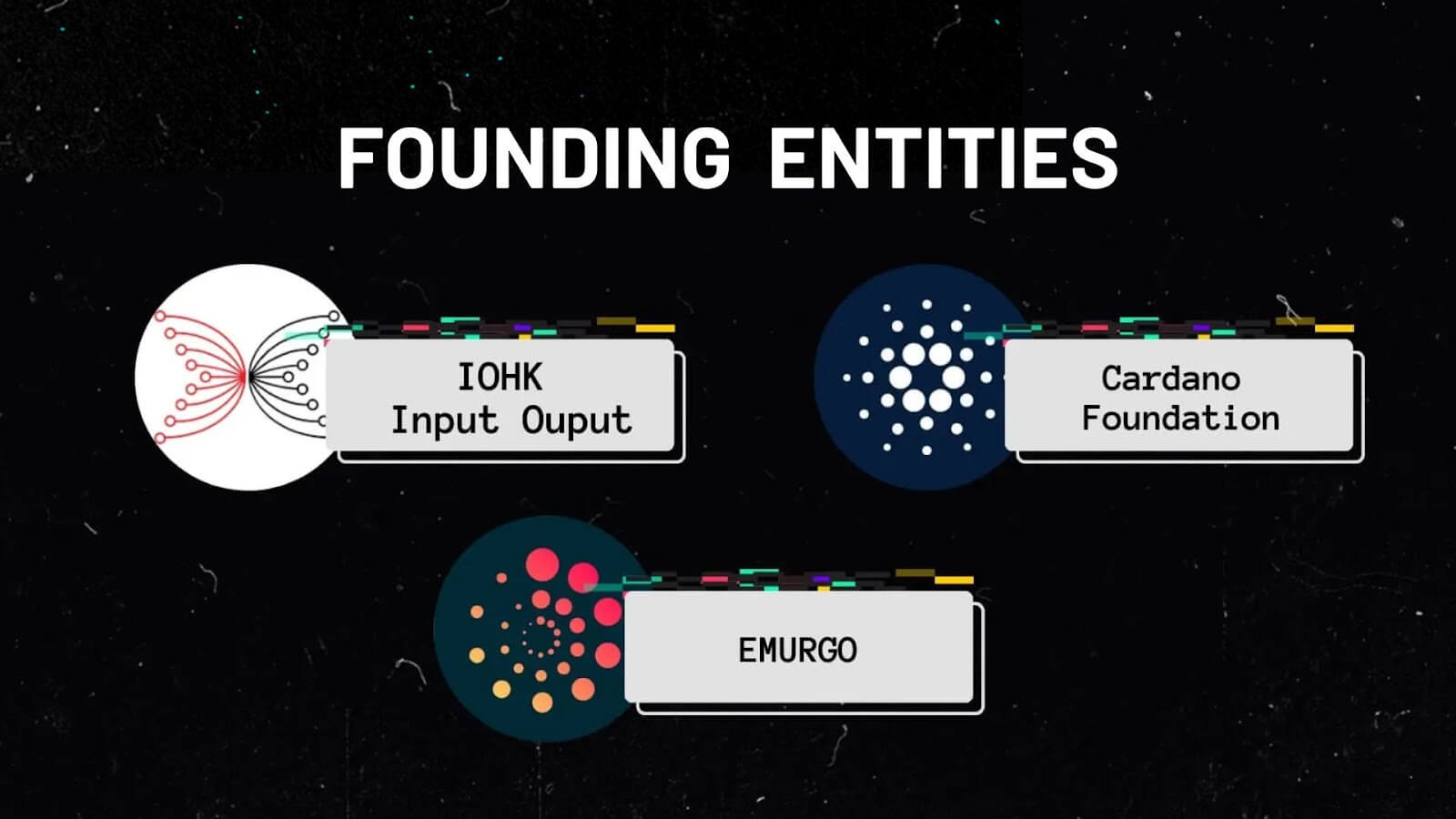

Thus, Cardano is supported by three large entities:

- IOHK – Input Output,

- Cardano Foundation

- and Emurgo.

IOHK

IOHK , a blockchain research and development company founded by Charles Hoskinson and Jeremy Wood, was hired to work with Cardano from 2015 to 2020. Despite the termination of the contract, IOHK remains involved, and the company’s Twitter continues to post related content to Cardano.

The curious thing is that IOHK is described on the cardano.org website as a completely decentralized company.

Decentralized company? These concepts are totally contradictory, they are antonyms!

Another irony is that the only mention of the word “decentralized” on Cardano’s official website is in the IOHK description. The language used in its official communications is quite institutional, resembling that of a corporation.

Cardano Foundation

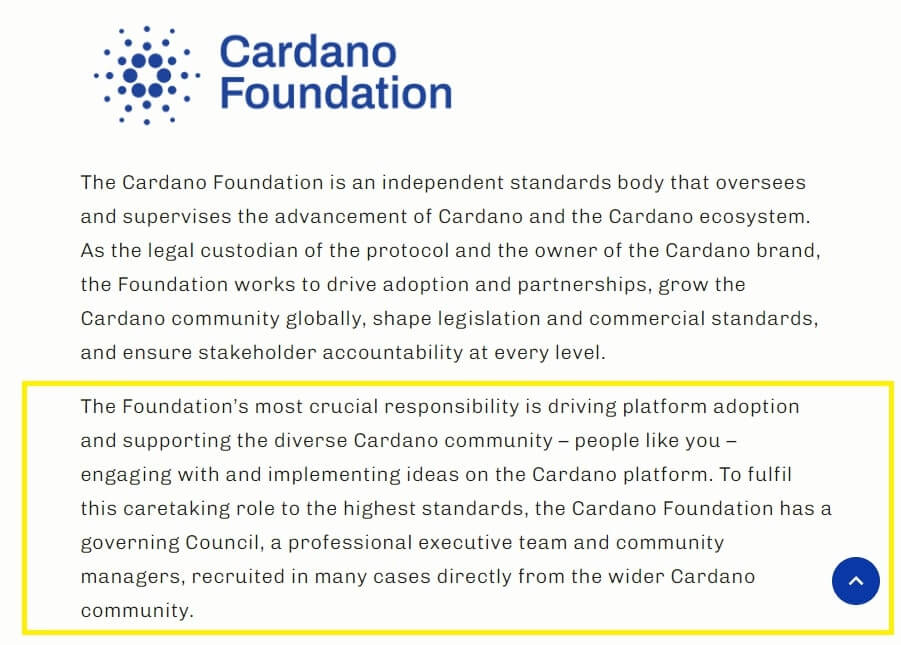

The second entity involved in the creation of Cardano is the Cardano Foundation, a non-profit organization focused on the development and growth of the Cardano ecosystem.

The Cardano Foundation is responsible for making technical decisions, organizing the selection of participants in staking pools, coordinating protocol updates, and issuing official communications.

However, despite its non-profit nature, the person who signed on as president of the Cardano Foundation during the ICO was banking consultant Michael Parsons. It was presented to potential buyers on March 28, 2016, by Attain Corporation, the company that managed Cardano’s pre-sale and ICO in Japan.

Emurgo

The third entity involved in creating the protocol was Emurgo, a Japanese for-profit venture capital firm.

Emurgo develops, supports, and incubates commercial opportunities, assisting in business integration with the aim of attracting capital and strategic partnerships to the Cardano ecosystem.

Creation, distribution, and launch of ADA tokens

Cardano has a limit of 45 billion units. The first 20% of this supply, equivalent to 5.1 billion, was pre-sold through vouchers, something similar to a “crypto voucher”.

These coins were directed to the three founding entities of the ecosystem: IOHK, Emurgo, and Cardano Foundation, as mentioned previously.

When the Genesis block began operating, 20% of the supply was reserved for holders of these vouchers. Therefore, these ADAs were not pre-mined; however, as soon as they were issued, they were already destined for project insiders. This implies that the Cardano team started with at least 20% of the supply secured for themselves.

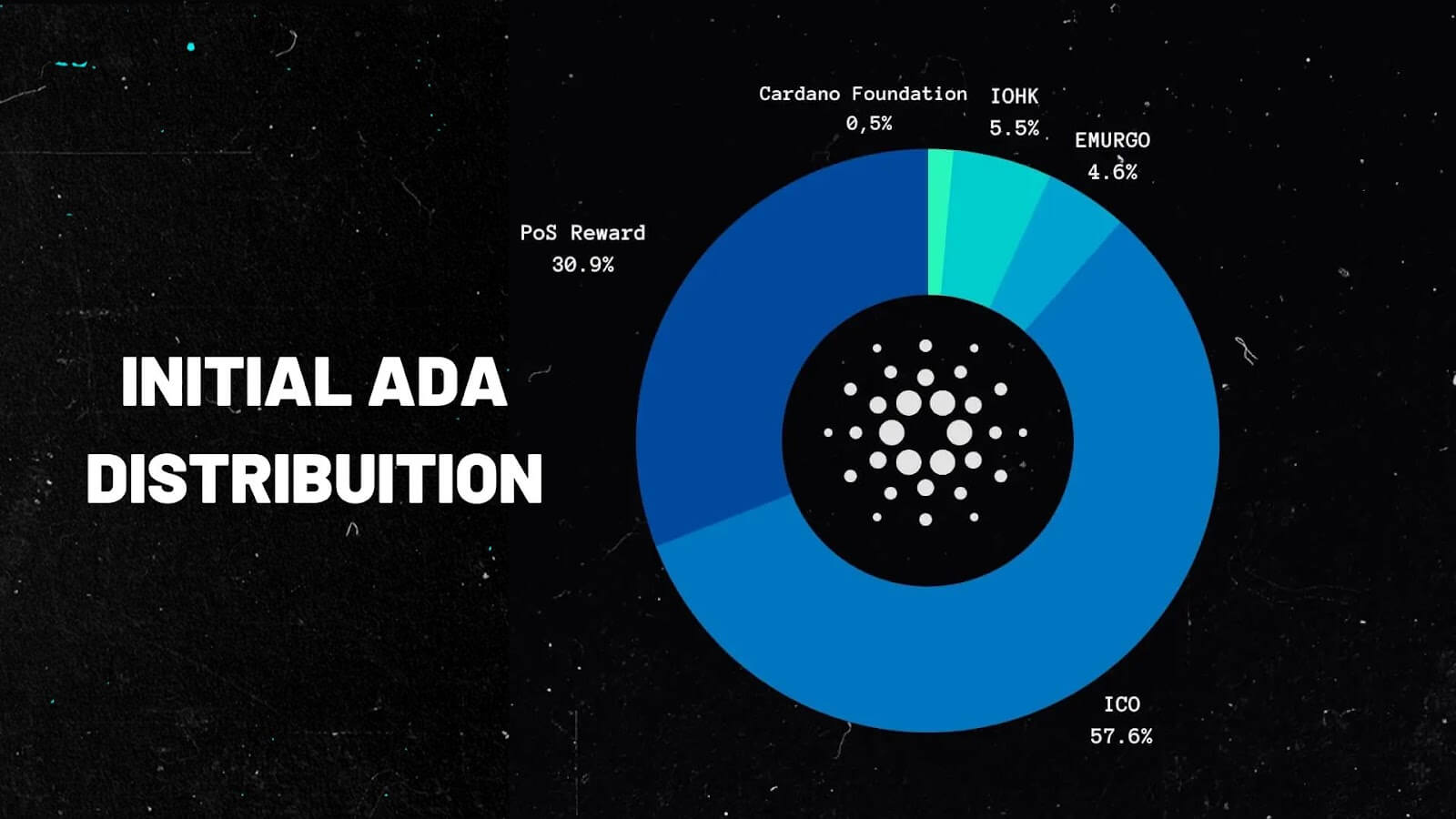

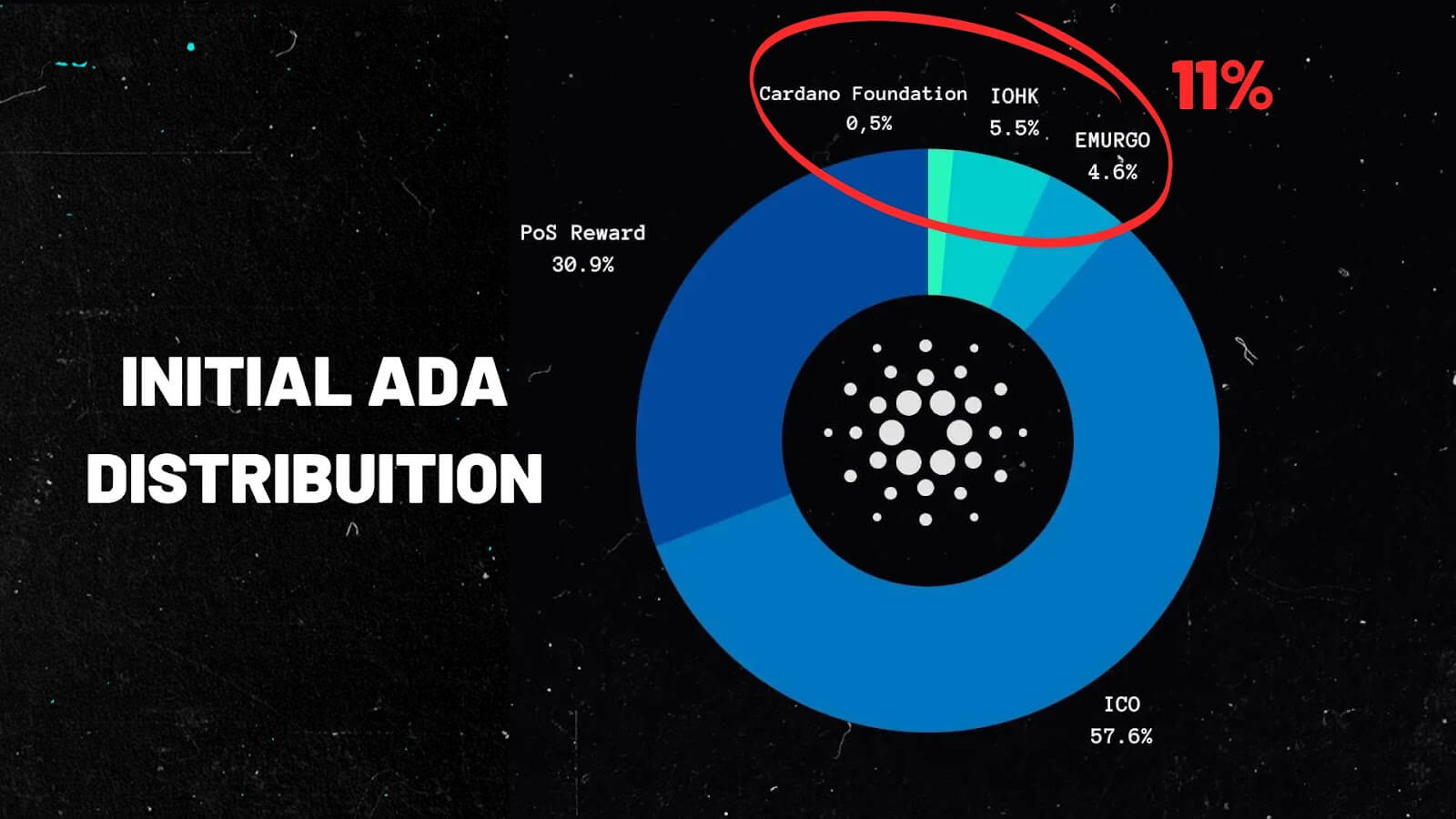

The distribution of this pre-sale was as follows:

- IOHK: received 2.46 billion ADA (5.5%)

- EMURGO: received 2.07 billion ADA (4.6%)

- Cardano Foundation: received 640 million ADA (1.4%)

At the end of the private pre-sale, held from 2015 to 2017, in October 2017, an ICO took place, where 25.9 billion ADA were sold, corresponding to 57.6% of the supply.

The fact that the ICO was exclusively in Japan is noteworthy. Cardano, or Adacoin, as it was called, was announced highlighting the success of Ethereum and Bitshares, both with Charles Hoskinson as founder. He was introduced to Japanese businessmen as a “genius” mathematician. His status as former CEO of Ethereum endorsed IOHK’s announcements, encouraging potential buyers to create profit expectations: “ Bitshares token price increased by 5.4x and Ethereum increased by 60x ”.

To participate in the ICO, Japanese entrepreneurs had to acquire at least the equivalent of $1000, either by Japanese bank transfer or Bitcoin.

On March 28, 2016, one Bitcoin was worth approximately $420.

The photo below was taken with Japanese investors near the Cardano ICO.

With 95% of ICO buyers being Japanese, Cardano became known as “the Japanese Ethereum”.

Hoskinson noted that this jurisdictional bias “was due to the origin of the project, but also due to its sales strategy.” According to Hoskinson, “There are three Asian crypto markets that matter: China, Japan, and South Korea. Of these three, Cardano decided to focus on Japan because it is the friendliest, most supportive, and offers the longest-term growth.”

Could it be that Japan is not the region where investors are most willing to take more risk while its economy struggles with negative real interest rates after controlling the interest rate curve a decade ago?

According to Japanese investors, after the initial coin offering secured funding for IOHK, its team stopped communicating with investors and justified that it had no obligation to contact them.

The culture of ICOs at that time included the founders’ presence on Slack, answering investor questions, and maintaining communication through blogs.

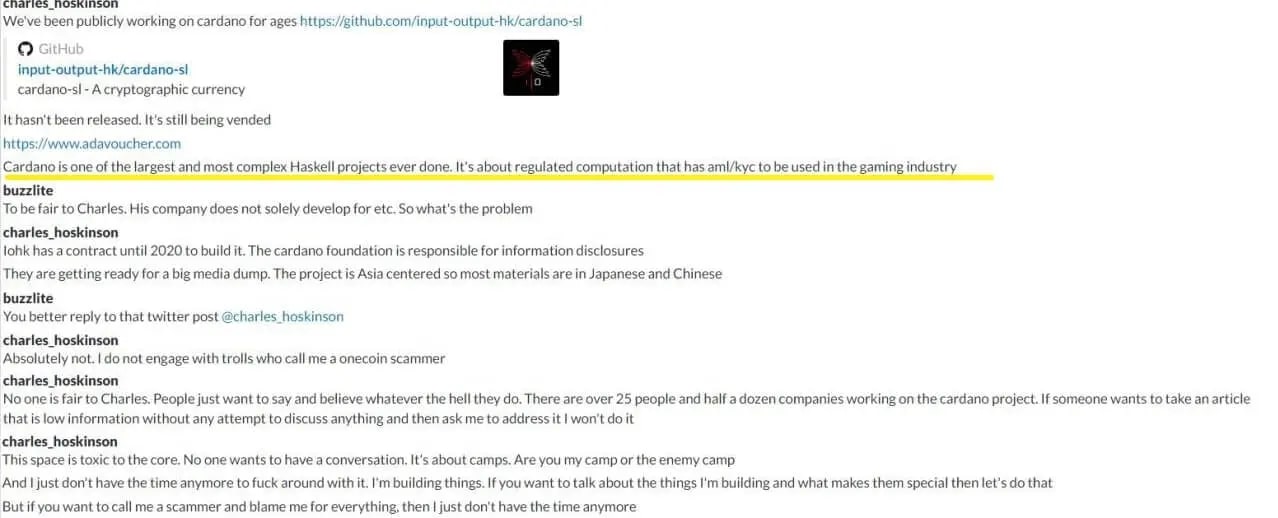

However, the Japanese began to compare Cardano with Onecoin, a globally known fraudulent cryptocurrency. Hoskinson did not accept the comparison and took to the Ethereum Classic Slack channel to comment, explaining why he refused to discuss Cardano with Japanese and Chinese investors.

Thus, according to Hoskinson, he refused to interact with those who accused him of being an Onecoin scammer, claiming that the environment was extremely toxic and that no one was interested in an honest conversation.

Attain Corporation’s contract expired in the first quarter of 2017, and the company deleted content from the cardano.biz website, now only available as an internet archive.

ADA Distribution and Launch

After the ICO, the coins were freely sold and made available on exchanges around the world. The likely reason for holding the ICO in Japan was to avoid Cardano being classified as a security, especially if there was regulatory pressure on cryptocurrency projects.

The SEC has long characterized ICOs as irregular sales of securities. However, Cardano’s initial offering took place in Japan, where regulation differs from the United States and would be outside the SEC’s jurisdiction.

Therefore, while the SEC cannot regulate sales made to Japanese citizens under Japanese law, it can question the secondary market in which American exchanges have offered Cardano trading through their platforms. Therefore, the SEC may consider that they were selling unregistered securities to Americans.

After the ICO, only 13.9 billion ADA, corresponding to 30% of the supply, were available to receive staking rewards. The total distribution of ADA is shown in the image below from the day of Cardano’s official launch in September 2017:

What draws attention to this initial distribution is that 70% of the coins had their destinations pre-determined before the Genesis block even began operating.

Only 30% of ADA coins would be distributed through consensus and block rewards, while 11% remained with pre-sale insiders, and 57.6% were sold in the ICO to selected investors.

Cardano’s founders played a central role in determining how the bulk of the supply would be created and distributed.

Therefore, more than 31 billion ADA, corresponding to 70% of the total supply, were created and their destiny was already determined on the day of the protocol’s launch.

This decision is quite centralized and has a decisive impact on the future of Cardano. If a PoS protocol can determine from the beginning who will have the most coins, these people will have greater validation power. This also puts pressure on new validators to purchase ADA from the protocol’s initial holders so they can participate in consensus and have a voice in protocol decisions, similar to what happens with companies and their common shares.

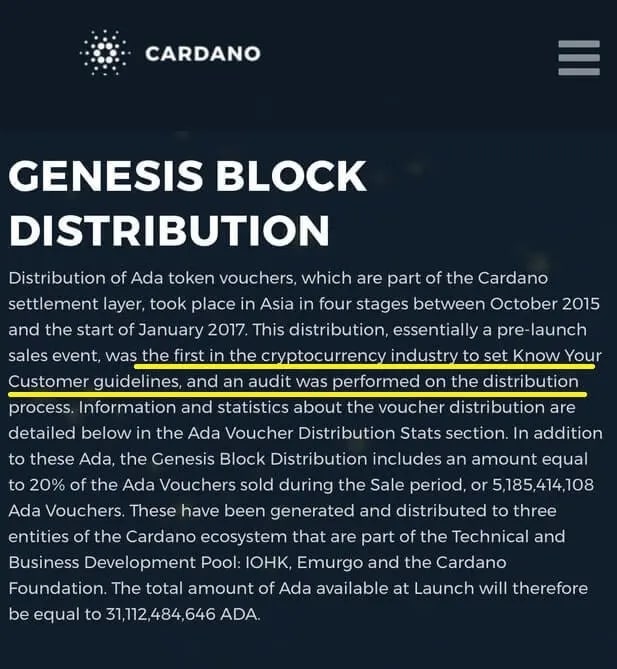

In addition to excessively benefiting insiders, the launch of ADA is very similar to an IPO of a company in the regulatory sense. It was the first pre-sale where KYC rules were followed, and audits were applied after the launch period.

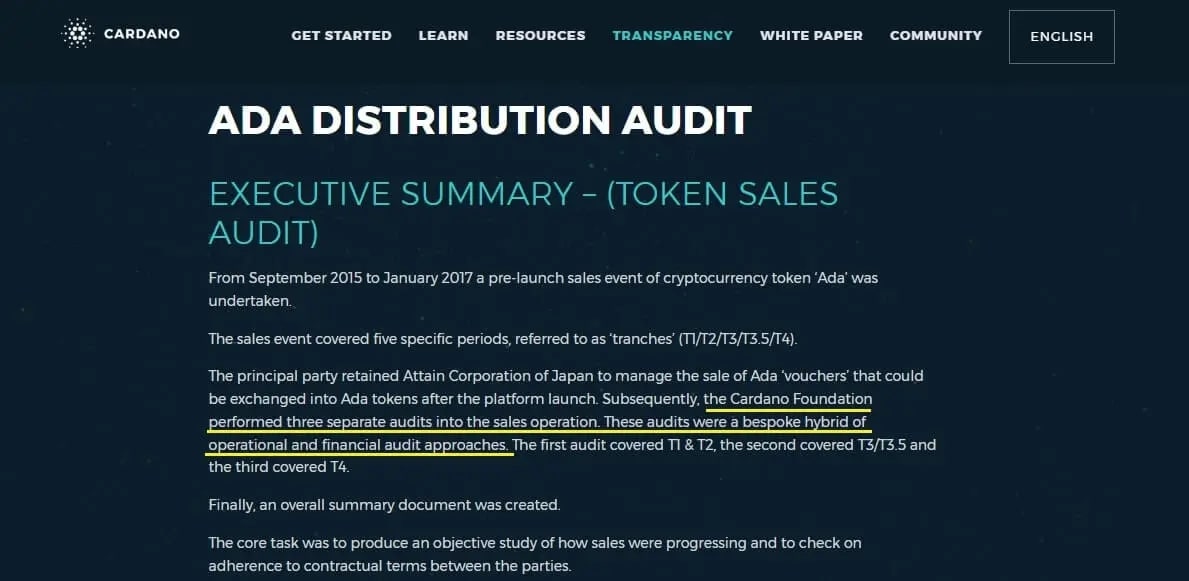

For more details about the ADA pre-sale, which took place in five stages, the Japanese company Attain Corporation was hired to manage the sale of ADA vouchers, involving yet another Japanese company. The Cardano Foundation carried out three separate audits of the sales operation, as shown in the image below.

What is striking is that on the Cardano website (as seen in the image below), there is a footnote stating that Cardano “ does not perform any independent due diligence or substantive review of any blockchain, digital currency, cryptocurrency or associated technology”. However, the Cardano Foundation carried out three audits on the distribution of ADA tokens.

Why wasn’t a company specialized in audits hired, independent of the negotiations?

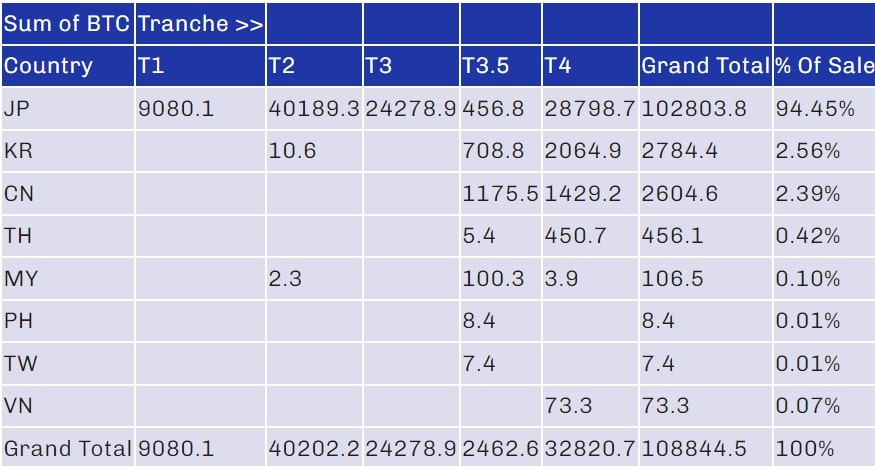

The audit website treats the pre-sale as something public and includes the countries where the coins went (table below).

However, it was a private sale to two companies (Emurgo and IOHK) and donations of ADA vouchers to the Cardano Foundation. This pre-sale was private, closed, and intended for project insiders.

How can a decentralized protocol have a venture capital firm like Emurgo as a founder and initial token recipient?

This puts Cardano much closer to a startup receiving investment from angel investors than a decentralized protocol.

Especially since Emurgo and IOHK received vouchers and paid with BTC for the ADA tokens purchased in the pre-sale, while the Cardano Foundation only received donations and did not invest/contribute in BTC.

Supply Now

Currently, the ADA monetary expansion rate is 0.3% per epoch. This means that, on average, every 5 days, 0.3% of the reserve balance for staking rewards is released, resulting in inflation of approximately 2% per year.

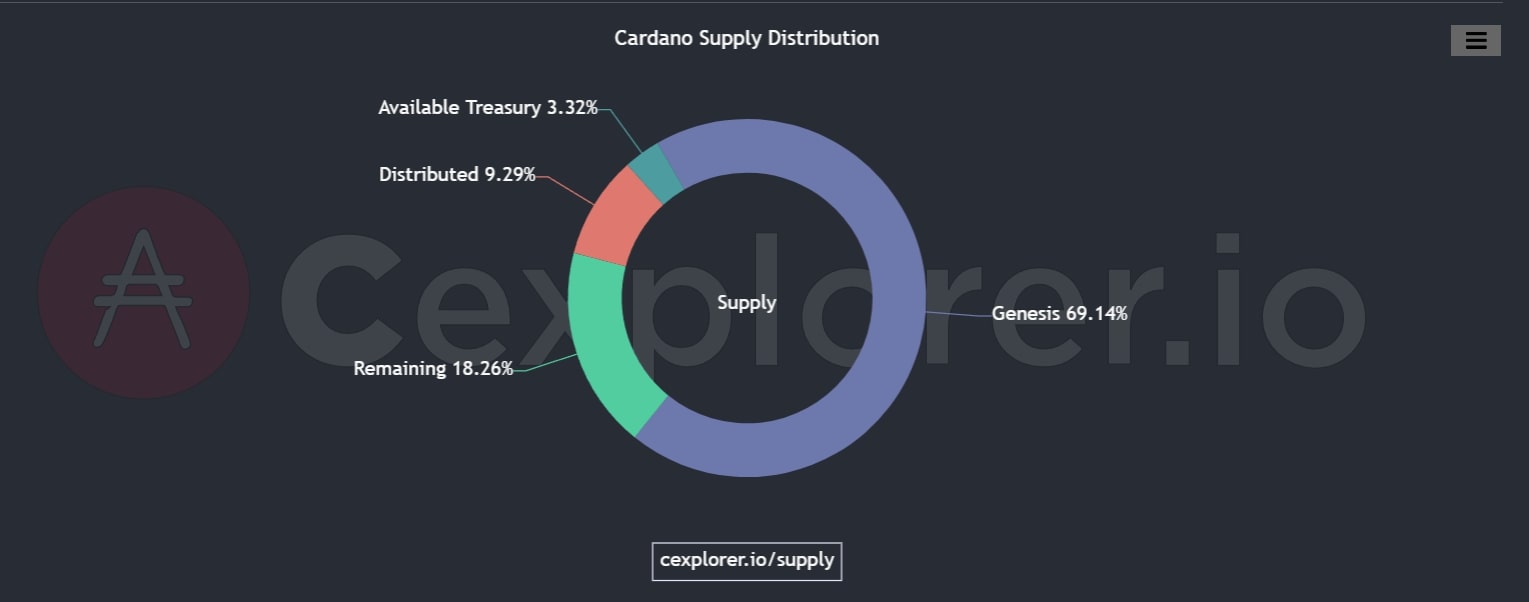

Cardano’s monetary expansion is being reduced over time, and it is expected that over time, transaction fees will replace the block reward if the protocol gains adoption. At present, over 81.75% of the ADA supply has been created, 18.26% will be released through block rewards, and around 3.32% is in the Cardano Foundation Treasury.

So far 36 billion ADA have been issued following the logic of epochs, in which each period established by the protocol a portion of coins are created. In the latest planned upgrade, called Voltaire, all 45 billion tokens will be issued.

Consensus and Functioning

Cardano uses Ouroboros as a Proof of Stake (PoS) consensus mechanism. In this system, ADA is the token used for payments within the ecosystem, earning rewards for validating blocks, and, in the future, it will also be used as a governance mechanism.

PoS Ouroboros works from groups of staking operators, called pools, where users leave their tokens and receive rewards for doing so.

The staking pool consists of a group that comes together to increase their chances of validating a block, unifying their balances to have greater validation power, and then the rewards are divided proportionally.

The big difference between Cardano Staking and other protocols is that it is liquid staking and does not lock the user’s tokens; You can withdraw at any time.

Another point is that it is also possible to do delegated staking, where users with a smaller amount of tokens can participate in staking by joining a pool that does not keep the user’s private key, called liquid staking.

In Ouroboros, it is possible to carry out two types of staking: normal, where users run their own node in a pool, and delegated, where users join pools that mediate and distribute the reward.

It is important to note that Cardano staking does not impose restrictions on withdrawals, unlike Ethereum. However, the initial creation of 70% of tokens without an equitable distribution, and without coming from block validation rewards, already puts the protocol in a centralized situation from the beginning.

Those who initially received these tokens and staked them have greater validation power, which could result in the centralization of new rewards and decision-making power.

Furthermore, Cardano’s PoS was linked to IOHK federated nodes for 4 years, only becoming publicly available from epoch 216 with the Shelley update. From 2017 to 2020, all ADAs created were issued by federated nodes, dependent on IOHK!

While many users believe that the ability to withdraw tokens at any time and maintain ownership of the keys when connecting to a pool represents decentralization, in practice, this is not the case. Decentralization means the absence of a single point of failure or monopoly of decision-making power in the network as a whole. If the code is modified maliciously, it doesn’t matter whether the user held the keys, as the problem would affect the code and the general consensus.

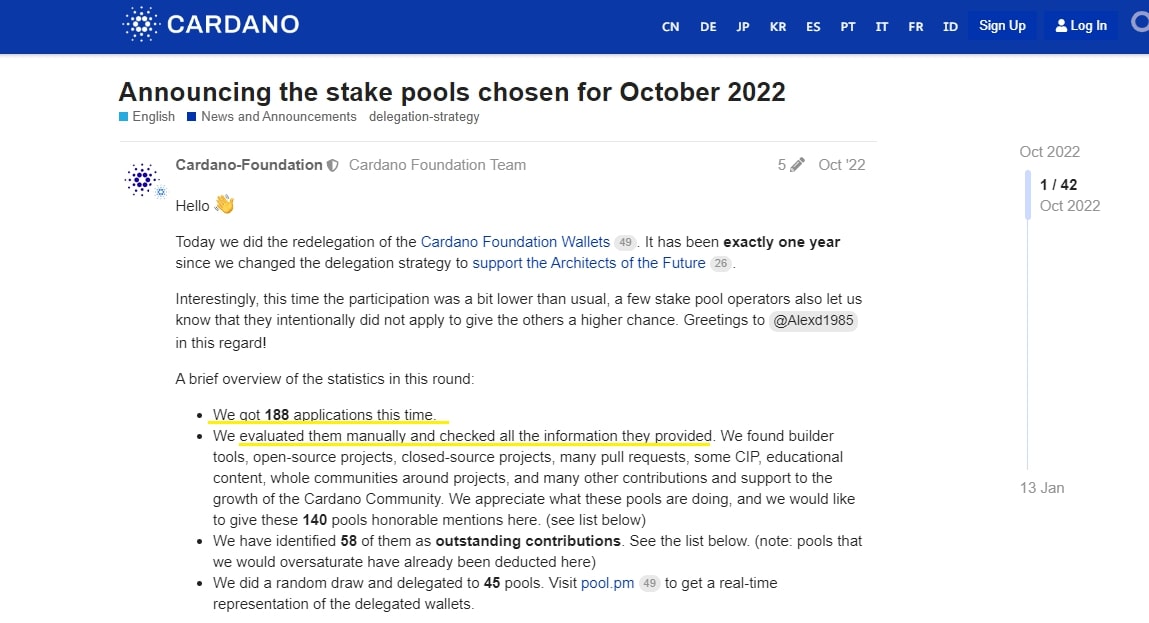

Another example of centralization is in the selection of pools. In October 2022, the Cardano Foundation announced that out of 188 requests for staking pool delegation, 58 were selected by the Cardano Foundation based on their contributions to the growth of the ecosystem.

If there is a manual selection and dependent on an entity that establishes the rules, how can it be considered decentralized?

This selection also acts as a barrier to entry for those who were not chosen. When there is a team making hierarchical decisions on an ongoing basis, there is no resistance to censorship and no free access to participate in the consensus mechanism. It is not truly permissionless, as approval from the Cardano Foundation is required to participate in the consensus, similar to needing a license to become a bank and receive interest for managing customer funds.

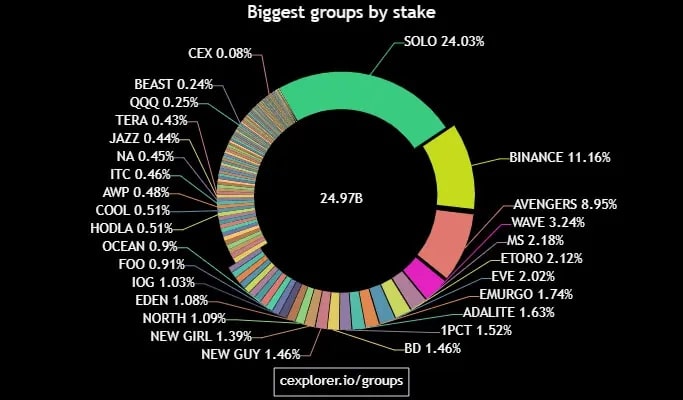

Therefore, even with the presence of several solo validation pools on Cardano, representing the majority compared to staking from centralized entities such as Binance and other exchanges, they still depend on centralized entities: the data centers.

Distribution of nodes

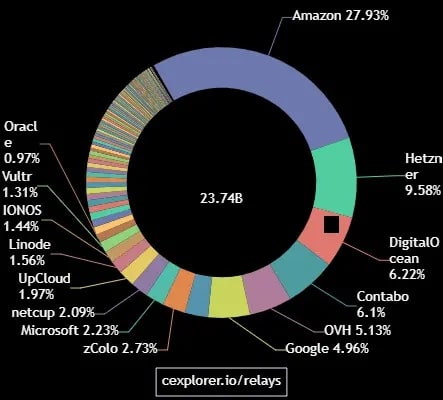

In addition to centralizing decision-making power over who can have a pool and participate in the consensus, the hardware of the network’s validator nodes is hosted on third-party servers in data centers.

Considering that 35 billion ADA have already been issued and 24.9 billion are staked, which represents 71% of the supply, the graph above shows that 23.7 billion ADA are correlated to pools whose nodes depend on data centers.

This means that 97% of pools depend on third parties to run and store information, and only 3% of the network is actually independent of private servers. This represents a major attack vector through regulatory capture or failures in service providers like Amazon and Hetzner.

Most nodes are in data centers due to the need for data storage to have a complete copy of the Cardano blockchain, which is currently around 99GB. This capacity, which requires more powerful and expensive machines, becomes a barrier for the common user.

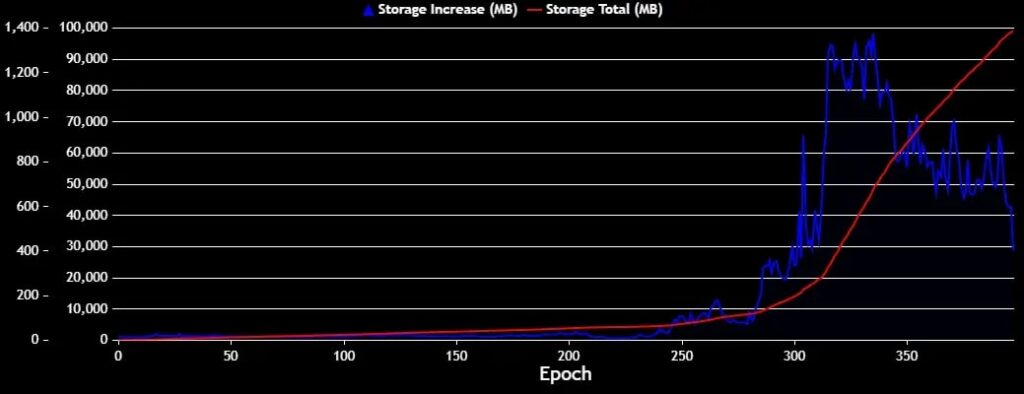

The constant increase in hardware capacity is a trend, as evidenced in the image below.

Therefore, the tendency is for Cardano to remain dependent on centralized cloud servers, as it requires increasingly powerful and expensive hardware to store its blockchain records.

Updates and Roadmap

Cardano is not ready yet; is being built with each update, in a process that involves 5 phases:

- Byron,

- Shelley,

- Goguen,

- They said

- and Voltaire.

The Byron era began in September 2017 with the launch of the main blockchain. During this phase, the chain operated as a federated network, supporting only ADA transactions. The next phase, Shelley, was launched in July 2020, starting the Ouroboros PoS protocol.

In 2021, the Goguen phase began, which allowed the creation of smart contracts and the issuance of native tokens. It is at this stage that the protocol is now. The development teams, IOHK and Emurgo, are researching and building the remaining phases of the network, Basho and Voltaire, in parallel with Goguen.

With each era, smaller updates are made, many of them through hard forks. This generates permanent divergences about the previous version of the Blockchain and makes the protocol not backward compatible. Hard forks force nodes to update themselves, excluding users from the network who may disagree with the changes.

This mandatory update is critical for fixing bugs, but it also demonstrates the centralization of decision-making power in the network. In other words, anyone who does not update according to the Cardano Foundation’s definitions will be stuck in a previously abandoned version that is incompatible with the new version of the network.

Compliance

Cardano has always indicated to regulators that it would follow regulations. In the pre-sale and ICO, he carried out the Know Your Customer (KYC) process for the token recipients, as we have seen previously.

When Hoskinson was asked about Cardano’s actions in Japan and how its protocol was being compared to the fraudulent Onecoin, he commented that Cardano was the only “regulated computing that follows AML/KYC rules in the gaming industry.”

However, what stands out is that the protocol recently partnered with Coinfirm to “advance regulatory compliance.”

However, the great risk of this type of partnership is making the network prone to censorship, politicization, and government capture, which goes against the initial purpose of decentralization.

This partnership with Coinfirm leaves Cardano and its users susceptible to regulators’ decisions. In this sense, Cardano resembles a global cyber bank offering a software service, subject to government decisions, regulatory capture, and censorship.

Problematic events

Now that we’ve gone through the main points that make Cardano centralized, let’s make an overview of events that happened in the protocol that expose risks and centralization.

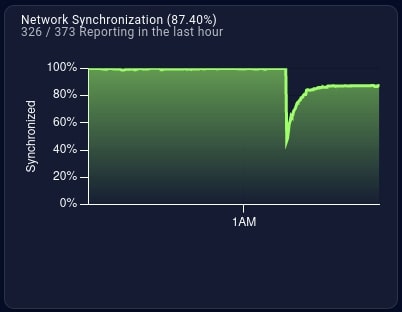

Network instability

Recently, in January 2023, the Cardano network had a bug that disconnected 50% of nodes, as shown in the graph below.

According to IOHK, the problem only affected the nodes where users connect to carry out transactions, known as edge nodes, which function as gateways. According to the devs, the work nodes that build blocks were not affected and this interruption was “ a transient anomaly ” for only one part of the network. In other words, the blockchain did not crash, but half of the nodes desynchronized and disconnected.

Charles Hoskinson and IOHK did not clearly communicate the cause of the bug, only stating that they would investigate the reasons for it.

The impact of the bug on the Cardano network was temporary; the event slowed down block creation without crashing the blockchain while nodes were rebooted.

The bug has not yet had an official explanation, but it appears to have been a problem in the code, and discussions have occurred on GitHub without a plausible explanation so far.

Interestingly, this bug occurred after many security discussions and reviews before updates and after the official Cardano testnet “cracked”.

Broken Testnet

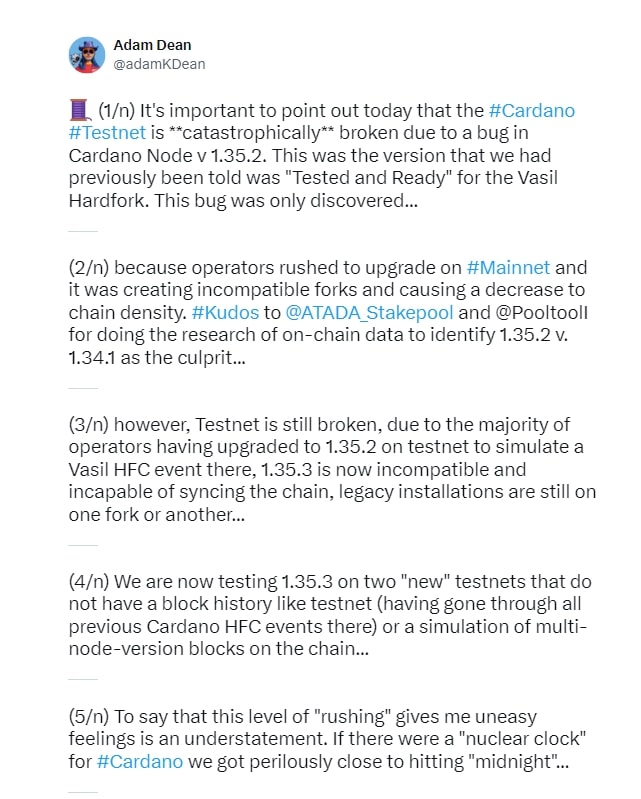

In August 2022, a Twitter thread revealed that Cardano’s testnet was “catastrophically” broken due to a bug in version 1.35.2 of the protocol, intended for the Vasil hard fork.

Source: https://x.com/adamKDean/status/1560295448333520896

The critical bug was discovered by operators of a staking pool, leading to the creation of multiple incompatible versions of the blockchain and leaving the testnet hopelessly broken. New versions failed to synchronize the chain, and as a result, two new testnets were created without the complete block history of the network.

Many users reported a rush on the part of Hoskinson and his team to update nodes and activate Vasil. Rumors suggest that the objective was to increase competition with Ethereum after its merge. Hoskinson refuted that the testnet was broken, stating that testnets are designed to address challenges, and highlighted the importance of moving forward with the Vasil update, which he said had been extensively tested and was ready to roll out.

The Vasil update normally took place in October 2022; however, the first bug, which disconnected 50% of nodes, happened in January 2023, three months after Vasil was implemented.

The big problem is that if the test blockchain does not represent a realistic version of the official blockchain, how do we know if the tests will prevent more bugs? What could happen to the official network if these bugs are overlooked?

The Vasil update normally took place in October 2022; however, the first bug, which disconnected 50% of nodes, happened in January 2023, three months after Vasil was implemented.

Scandal in Ethiopia

Kal Kassa, a resident of Ethiopia, exposed in an article how Charles Hoskinson and the Cardano team had, according to him, “ deceived the people of Ethiopia ”.

Kassa participated in events promoted by IOHK, EMURGO, and the Cardano Foundation, in which a memorandum of understanding was signed on blockchain technology to track Ethiopian coffee along the production chain, in collaboration with the Ethiopian government through the Ministry of Science and Technology.

The agreement was formalized in the presence of Dr. Eng. Getahun Mekuria, former Minister of Science and Technology, and Charles Hoskinson, during the signing of the MOU on May 3, 2018, in Addis Ababa, Ethiopia.

According to the Ethiopian Ministry of Peace, Cardano’s founders have committed to creating identity cards in Ethiopia. However, in February 2021, the Cardano subreddit removed a post related to this commitment. Subsequently, there were contradictory statements, backtracking and stating that Cardano was not working with the Ministry of Peace.

In late April 2021, it was announced at a major conference that Cardano would collaborate with the government of Ethiopia. However, to date, three years later, according to Kassa, nothing has been done.

He argues that, ultimately, Cardano appears to have used the negotiations with Ethiopia for self-promotion on social media and news portals, constructing a false narrative that Cardano was generating opportunities, while, according to its claims, no real progress has been achieved.

Howey test

After an in-depth analysis of the technical, social, and organizational aspects of Cardano, it becomes clearer to apply the Howey test to assess its nature.

1. Does it involve an investment of money?

Yes! Cardano’s founder is Emurgo, a company with commercial appeal, which received tokens in the pre-sale. The ICO itself focused on Japanese investors demonstrating that Cardano had several private initial investors at many stages and from the beginning of the project.

Furthermore, on Daedalus, Cardano’s wallet, there is a legal notice that treats all tokens as investments.

2. Is it a regular company?

Yes. The hierarchical structure, with C-level positions in the founding companies and the Cardano Foundation, reflects a business organization. Centralized decisions on upgrades and the selection of staking pools also indicate enterprise characteristics.

Recently, Hoskinson stated during a live broadcast on his YouTube channel that he “accidentally” opened a screen and “leaked information”.

Well, if an open-source protocol has confidential information known only to insiders, then it is a company and not a decentralized protocol.

3. Is there an expectation of profit?

Yes. From the beginning, aggressive communication during the ICO generated expectations of profit. The main marketing tool during the ICO, focused on Japanese investors, was to generate profit expectations and compare the potential performance of Cardano with that of Ethereum after the ICO.

Due to this aggressive marketing, several Japanese newspapers suspected that Cardano would be the new Onecoin. Additionally, PoS protocols offer rewards for leaving coins in staking pools for validation, thus promoting the expectation of “passive income” or rewards.

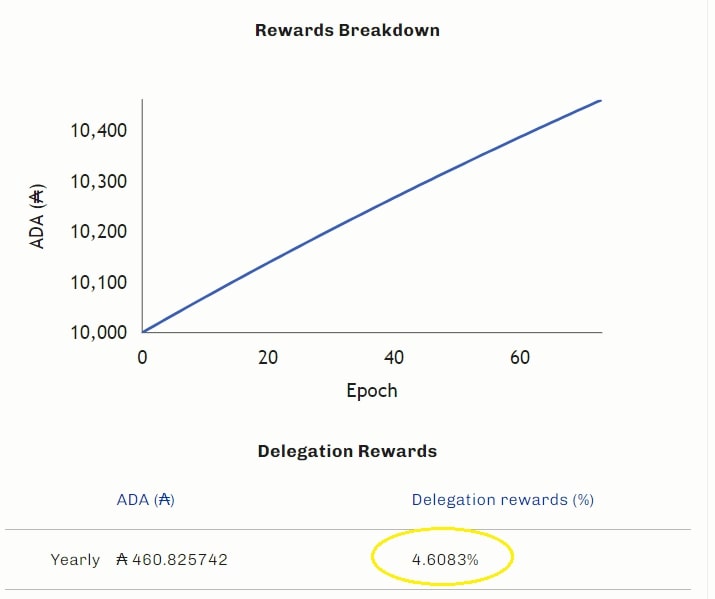

Cardano also has a calculator that generates an estimate of these gains, as you can see below:

Obviously, there are disclaimers warning that this calculator is just an estimate and does not guarantee any type of return; however, the rest of the communication says exactly the opposite.

There is even a graph that suggests that, over the years, the return has been increasingly greater, and that the rewards are around 4.6% per year.

Wouldn’t that be generating an expectation of profit?

4. Does growth depend on the efforts and promotion of others?

The Cardano Foundation is the main entity responsible for promoting Cardano, attracting users, and even forming partnerships with marketing companies.

In the image below, the Cardano Foundation explains its role as a promoter of Cardano adoption. Decentralized protocols do not have a sector responsible for the project’s growth; companies do this.

Cardano even hired McCann, a marketing agency, to promote the protocol and guide its brand strategy. Brand strategy…really?

The announcement of the partnership was made on Cardano networks in Japan.

Therefore, it is another check ✅ on the Howey test. In this way, we come to the conclusion that Cardano is indeed a company disguised as a decentralized protocol.

The company from the beginning

Cardano has done everything to stay out of the SEC’s jurisdiction. This discussion on a Cardano forum exposes the creators’ efforts to have EMURGO and IOHK outside the US to survive a regulatory capture if it were to happen.

What is most bizarre is that the company EMURGO will launch STOs, security tokens, and company tokens, on the Cardano blockchain, as if Cardano itself were not a security!

Conclusion

From everything exposed in this article, we come to the conclusion that Cardano communicates using conflicting information to benefit from the lack of common understanding about the main concepts of decentralization.

It behaves like a company and does KYC, auditing, and liability disclaimers on official websites, but on social media and marketing, it describes itself as a decentralized protocol.

Emurgo, Cardano Foundation, and IOHK have great decision-making power, as partners in a company. The risk of centralizing decision-making power involves making decisions on changes to the code for the benefit of the managing members to the detriment of users.

Additionally, Cardano Foundation has partnered with Coinfirm and this reflects the risk of regulatory capture for the protocol as a whole.

Nodes centralized on company servers also present a risk of user censorship, regulatory capture of the network, and bugs if these services are unexpectedly discontinued. Cardano has a consistent track record of over-delivering followed by under-delivering. Updates through hard forks, asymmetric token distribution and nodes concentrated on big tech servers expose the concentration of power at many levels.

Therefore, after all this analysis, it is clear that Cardano responds positively to Howey’s test and is a security of an unregulated software company managed by 3 entities: EMURGO, Cardano Foundation, and IOHK.

In this sense, security risks involve:

- Regulatory capture,

- Censorship,

- Exit liquidity,

- Rug Pulls,

- Bugs and backdoors,

- and hacks.

It is important to be aware of these risks in case of exposure to the protocol.

I hope you enjoyed the article and see you next time!

Share on your social networks:

One of the leading Bitcoin educators in Brazil and the founder of Area Bitcoin, one of the largest Bitcoin schools in the world. She has participated in Bitcoin and Lightning developer seminars by Chaincode (NY) and is a regular speaker at Bitcoin conferences around the world, including Adopting Bitcoin, Satsconf, Bitcoin Atlantis, Surfin Bitcoin, and more.

Did you like this article? Consider buying us a cup of coffee so that we can keep writing new content! ☕