Both Proof of Work (PoW) and Proof of Stake (PoS) are consensus mechanisms, meaning they are methods of coordination. Decentralized networks need to coordinate without a central entity determining what is and isn’t correct, or what is valid and invalid.

But should Bitcoin migrate to Proof of Stake in order to use less energy and increase scalability?

Before answering this question, let’s understand each of these mechanisms!

What is Proof of Work? How does it work?

Proof Of Work is a way of proving results by solving cryptographic puzzles through trial and error.

Computers compete to find the correct answer. Thus, the computer that first finds this answer will receive bitcoin as a reward and close the block of information.

To accomplish this, electricity, computational power, and powerful machines are needed to convert energy into immutable blocks of information, which are then lined up chronologically.

This chain of blocks demonstrates the computational power necessary to alter or corrupt the data recorded in this timeline of information. So, the more blocks, the more challenging it is to change, and the safer the information is.

PoW is the bridge between the digital and the physical because it anchors the creation of new BTC in real-world expenditure. Therefore, this means that bitcoin is not created from “nothing,” without any cost. The cost is the energy and the necessary equipment to participate in the network.

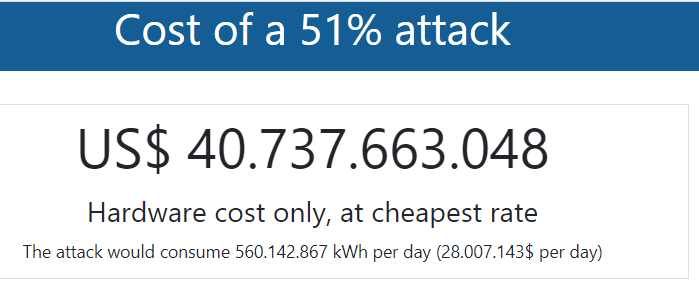

How much does it cost to attack the Bitcoin network?

The cost to carry out a 51% attack on Bitcoin is approximately $40 billion in quantum computers and $28 million in energy per day. Furthermore, there’s no guarantee that the attack would be successful.

Such an attack would require mobilizing the entire ASIC production industry, draw attention due to the sudden scarcity of these machines on the market, and alert the network to an attack attempt.

Thus, attacking the Bitcoin network is not a simple matter as it involves coordinating machines and energy. It’s an attack that would take time and a great deal of planning.

Moreover, Bitcoin’s network hashrate has been continually increasing, so an attacker would need to anticipate that the network’s future computational power will be even greater than the present.

Therefore, carrying out this operation quickly and secretly so that the network does not notice is extremely difficult.

Energy, Bitcoin, and Waste

The Bitcoin network encourages miners to be as efficient as possible. Therefore, the cheaper the energy, the cheaper it will be to mine a block.

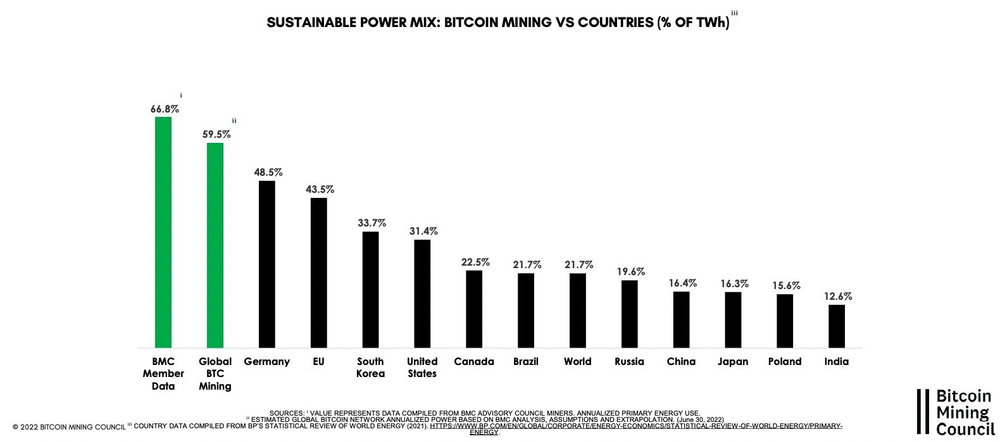

That’s why 59% of miners are located in regions with renewable energy sources, regions with energy surplus, places where energy is so abundant that a large part of the production is even discarded, and places where energy tends to be incredibly cheap.

This image from the Bitcoin Mining Council demonstrates that Bitcoin’s energy grid is more sustainable than countries aiming for more energy sustainability. Therefore, if Bitcoin were a country, it would be the most sustainable one.

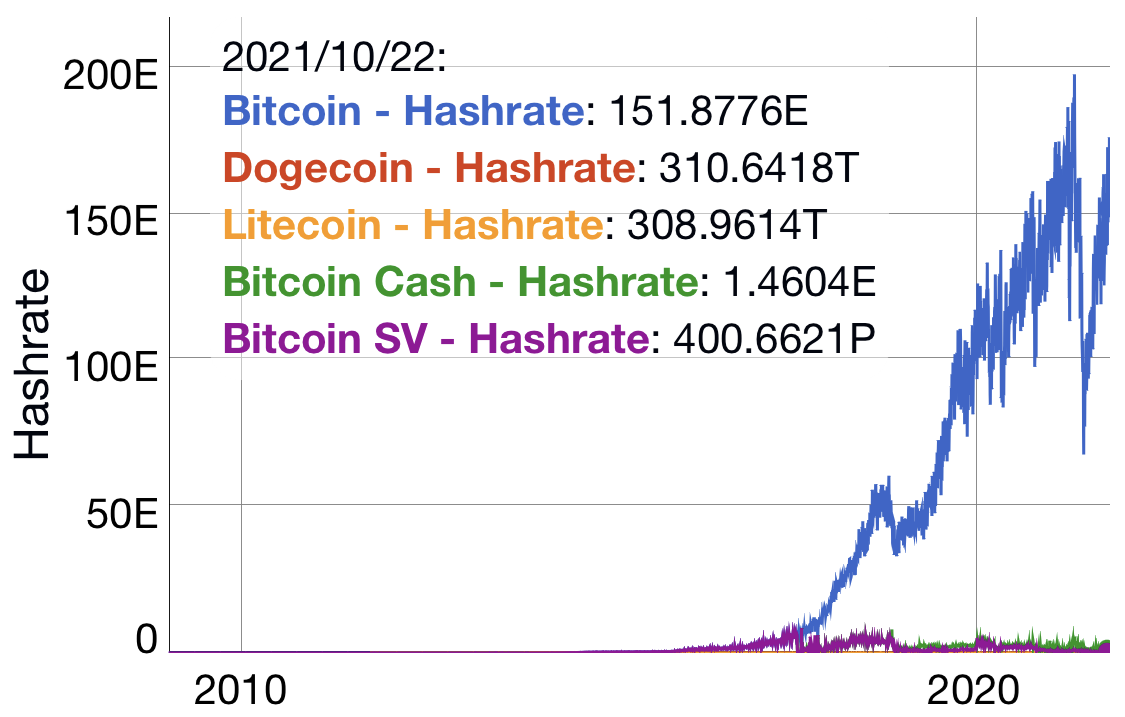

In addition to being more energy-efficient, Bitcoin has the most secure network because it has the most computational power allocated.

When we compare Bitcoin with other protocols that also use Proof of Work, the computational power (the hashrate) of other networks is much lower than Bitcoin’s network:

The energy expenditure to produce each block might seem like a waste to those who don’t understand the process, but it’s the only way to have a digital network that assures the value cannot be corrupted.

You cannot create energy from nothing. It’s a law of physics!

This law states:

“Energy cannot be created or destroyed; energy can only be transformed.”

Just as you also transform time and energy into wages. In this case, you spend energy and time working, and you receive your salary as a reward.

It’s the same thing with the Bitcoin network! This

mechanism ensures the network’s integrity because you cannot print energy; you can only convert available energy into immutable information.

Therefore, the more blocks that pass, the harder it is to change this timeline. The information blocks are protected by the thermodynamics of mining, by the conversion of energy into money, into Bitcoin.

This security, however, does not allow for agility and scalability in the production of new blocks, and that’s why the Bitcoin network can only scale on other layers.

The blockchain layer serves to secure the value of all layers above it. It’s an incorruptible value layer that can only scale by guaranteeing this value to adjacent faster layers.

That’s why the Lightning Network has been growing and becoming the next evolutionary layer of the Bitcoin network, aimed at payments and decentralized applications.

What is Proof Of Stake and how did it emerge?

Many people disagree with the way Bitcoin is structured.

Thus, many protocols want to have everything on the blockchain layer, such as agility, scalability, and security, trying to overcome the famous blockchain trilemma, which states that you can’t have everything on layer one.

But, even so, many people still want to find a way to do this. That’s how Proof of Stake (PoS) came about, removing the mining process.

Proof of Stake does not involve mining, but VALIDATION. In this mechanism, the validator needs to prove to the protocol that they have coins locked in it. In other words, the more coins you have, the more validation power you have.

Ethereum, Cardano, Solana, Polkadot, and other protocols already use PoS, even if partially, or in conjunction with other consensus mechanisms.

But how does Proof of Stake work?

In PoS, the creator of the next block is chosen through a lottery-like process, so validators need to lock tokens in the network. Thus, the more tokens you have locked or staked in the network, the higher your chances of winning this lottery and validating the next block, and also receiving the reward for it.

In PoS, it’s the quantity of staked tokens that protect the network. Thus, attacking the network would mean acquiring a significant portion of the staked coins allocated to the protocol.

This system does not require energy expenditure, so many PoS advocates argue that it is more sustainable than PoW. But, just because it doesn’t use energy, doesn’t mean that PoS is more efficient. This is because you can’t create value from nothing. Value comes from work, effort, and the energy allocated to create something.

Therefore, if the network’s coins have no cost to be produced, if they are created at zero cost, this means that their value is also zero.

This is a major concept that many people don’t understand. So, if a network creates coins out of nothing, just by typing values into a blockchain, it’s because the real value of these coins is also zero.

It would be like writing a number on a piece of paper and saying that it’s money.

This means that there’s no incentive to ensure the security and immutability of the network. Therefore, if an asset costs zero to be created, it can be easily counterfeited or defrauded. Thus, it’s expensive to produce something that guarantees it won’t be counterfeited. This is one of the basic physical characteristics of the most solid money ever created: gold.

Proof of Stake opens the possibility of centralizing the network by centralizing the coins, just like what happens in the fiat system where banks centralize all liquidity, and central banks centralize monetary policies.

In Bitcoin’s PoW, even if someone has many BTC, that person cannot influence the network’s decisions in the next block.

To have influence and monopolize, it is necessary to centralize energy, powerful specialized machines. This is not a simple and easy thing to do; it would take years, and the network would have time to anticipate and protect against these movements.

The Energy Securing Value

It’s like trying to make popcorn without turning on the stove; without the energy to transform corn into popcorn, you add no value to the final product.

You’ll never be able to sell this corn as popcorn because it hasn’t actually become popcorn; it didn’t undergo the action of fire (energy) to cause that transformation.

Blockchains using proof of stake produce many tokens, many corns, but they lack the energy component that gives value and transforms something purely digital and valueless into an asset with absolute digital scarcity, decentralized, verifiable, and immutable.

It is the energy expenditure that guarantees immutability and trust that the network will not be monopolized, even if the coins are.

PoS is also not immutable because to use less energy, you need to sacrifice resistance to censorship and decentralization. Whoever has more tokens has more validation power.

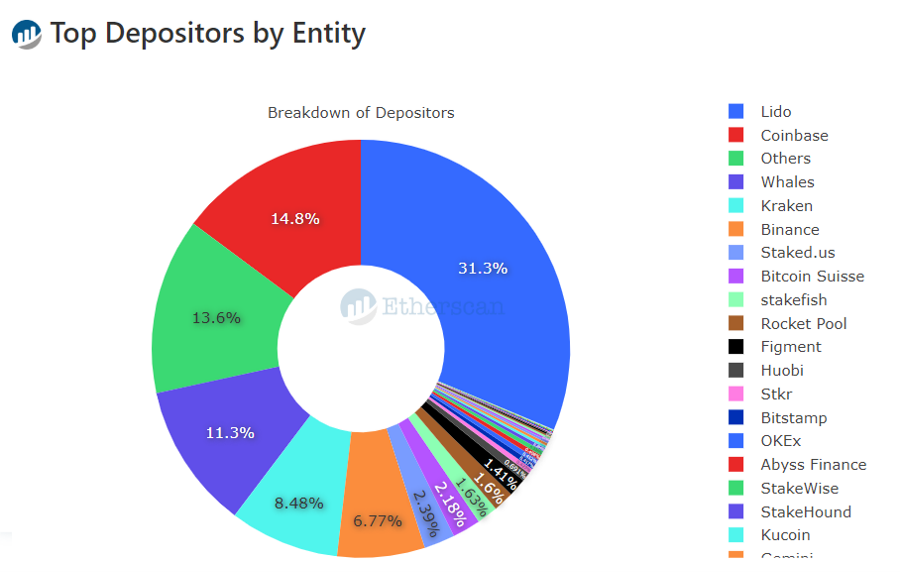

On the Ethereum network using PoS, for example, the biggest depositors are centralized exchanges like Coinbase, Kraken, and Binance. In addition to a DAO called Lido that has 31% of the staked deposits and also has its governance tokens centralized in the hands of investors, founders, and insiders.

This shows the high degree of protocol centralization, companies abide by governmental compliance laws. If pressured by entities, they can censor transactions or network users. This was quite exposed during the sanctions case against the Tornado Cash protocol supported on the Ethereum network.

Including, PoS systems seek to achieve immutability through the idea of punishment “slash”.

The idea is that if you misbehave, you pay a penalty by losing your funds.

The problem is that this punishment does not prevent the swindlers from operating. On the contrary, PoS can only punish bad actors after the fact has happened, which may be too late to recover the lost value.

This is drastically different from PoW mining.

In PoW mining, attackers need to pay an upfront cost to mine the block. That is, to attack, you have to pay first. We emphasize that, no one, at least for now, has the energetic and equipment backing to reach 51% of the Bitcoin network’s computing power.

Furthermore, this PoS punishment depends on “social consensus,” which means it depends on other people deciding what was valid and what was an attack. And that’s when these systems cease to be decentralized because they end up depending on other people to decide what to do.

Definitely buying an opinion is much easier than buying ASIC machines, going to a country with abundant energy and starting to compete for rewards.

To some extent, all systems need social consensus. After all, the value of bitcoin is subjective, and that is a social consensus. But, there is no social consensus in Bitcoin when it comes to determining which chain is valid or not. Therefore, the longest and safest chain will always be valid.

The decision in the event of bugs or malicious actions always goes in the direction where more energy was employed: the longest chain.

In PoS, what counts is the validator’s last word, not the previous record history, making their systems highly subjective when it comes to a decision that should be technical, mathematical, and thermodynamic.

That’s why systems using PoS ended up swapping decentralization for scalability and speed.

Without this anchor in the real world, in energy, proof of stake brings no extra benefit over traditional centralized systems that already exist!

In fact, it makes the network much more susceptible to bugs, bribery, and monopoly.

Here’s a question for you to ponder: how different is this from the current political system where you simply buy voting power?

Another point of centralization is that the largest validators of protocols using PoS are exchanges. That is, precisely those who have the highest volume.

This shows how much proof of stake resembles the current fiat system. The centralization of monetary policies rests with the teams of each protocol, and those who have all the liquidity are the exchanges.

Through proof of stake, exchanges become the banks of the crypto world.

Those thinking about innovation without first looking at decentralization are trading immutability for speed.

Speed can be achieved in layers above bitcoin, but immutability cannot be achieved in adjacent layers in PoS protocols.

It’s like building a building in a swamp; if the base isn’t solid, the floors above could collapse if there’s any shaking in the foundation.

That’s why the Bitcoin protocol has no intention of switching to proof of stake.

In proof of work, Bitcoin has fundamentals very similar to those of gold itself. Gold remains the world’s most valuable asset. It’s impossible to recreate, copy, or produce more gold than exists. Gold represents all the trust we have in the immutability and stability of the way atoms are arranged.

Cheaper, more versatile, or more scalable metals are not as valuable as gold is, and the same goes for decentralized protocols.

Value lies in preserving the fundamentals and preserving all the energy spent mining each block through properties that remain unchanged.

Bitcoin mirrors this same immutability of gold in the digital world. Therefore, wanting to change Bitcoin is to not understand or want to destroy its entire value proposition.

After all, the most environmentally responsible solution is the one that ensures security and efficiency in maintaining value in the long term. Blockchains using PoS could be BTC sidechains, but as a main chain, they offer inferior properties to PoW.

Bitcoin will not change its consensus mechanism because it focuses on maintaining very solid properties.

Bitcoin wants to be the new gold, an asset that protects value for millennia and not the new Apple that in a few decades may be replaced or surpassed by another innovative company.

Think about it and don’t forget to share this post!

Opt out and stack sats.

Share on your social networks:

One of the leading Bitcoin educators in Brazil and the founder of Area Bitcoin, one of the largest Bitcoin schools in the world. She has participated in Bitcoin and Lightning developer seminars by Chaincode (NY) and is a regular speaker at Bitcoin conferences around the world, including Adopting Bitcoin, Satsconf, Bitcoin Atlantis, Surfin Bitcoin, and more.

Did you like this article? Consider buying us a cup of coffee so that we can keep writing new content! ☕