ASICs (Application Specific Integrated Circuits) are specific (and essential) equipment used in Bitcoin mining.

These machines were built and developed as Bitcoin mining evolved.

In the beginning, it was possible to mine Bitcoin using conventional computers and even notebooks. However, as the network advanced and more people adopted the currency, it became necessary to use more advanced and powerful means to compete in hash rate (computing power).

However, nowadays, it is no longer viable to mine Bitcoin at home, as before. Additionally, while it is technically possible to keep an ASIC at home, it is not very common.

Currently, these machines are the most advanced available for mining, and several large companies are part of the Bitcoin mining industry.

That said, let’s understand how ASIC miners work!

Table of Contents

How does Bitcoin mining work?

Before we go on to understand how ASIC miners work, it is important to understand how Bitcoin mining works.

In short, on the Bitcoin network, miners compete with each other, through trial and error, to discover who first finds the hash that completes each block of information. Therefore, the miner who finds the hash first wins the reward, and the block is mined.

This process occurs repeatedly on the Bitcoin network, resulting in the emergence of new blocks. Thus, the greater the computational power used, the greater the chances of the miner finding the hash and the faster the block will be mined.

Therefore, the Bitcoin network adjusts so that the mining of new blocks occurs in an average of 10 minutes. The difficulty of solving this equation is adjusted as the computational power of the network increases.

In the beginning, when only Satoshi Nakamoto was mining, the difficulty was not very high. However, as more participants joined and started mining, the hash rate increased so the difficulty increased too.

At the end of 2023, mining difficulty on the Bitcoin network reached its record high of 475.9 EH/s (exahashes per second), indicating that the network was breaking its record in computational power and security.

Therefore, for mining to continue operating efficiently, maintaining network security, and enabling the inclusion of new participants, equipment had to be updated as technology evolved.

Evolution of mining equipment

As previously stated, mining has evolved over time and, of course, the equipment used has also advanced.

When the first Bitcoin block was created on January 3, 2009, Satoshi Nakamoto was the only person on the network, thus being the sole miner.

At that time, the mining difficulty was low compared to today, making it possible and viable to mine Bitcoin using a common computer.

However, over time, more sophisticated equipment became necessary, and the machines evolved, as you can see in the image below:

2009 – CPU Mining

Common computers, used to access the internet and operate everyday applications, are equipped with a Central Processing Unit, better known as a CPU. This is the computer’s brain, responsible for executing program instructions through basic operations such as arithmetic, logic, and input/output.

In 2009, when the Bitcoin network was still small and little known, mining using CPUs was sufficient to meet initial demands.

At that time, the CPU, with its ability to perform complex operations, was capable of solving the cryptographic puzzles necessary to mine new blocks and receive Bitcoin rewards.

However, as Bitcoin’s popularity grew and more miners joined the network, the mining difficulty increased significantly.

CPUs, despite being versatile and capable of performing multiple tasks, were not specialized in mining and began to become inefficient compared to the new technologies that emerged.

It was then that it became necessary to use more advanced and specialized hardware, such as GPUs (Graphic Processing Units).

2010/2011 – Mining with GPU and FPGA

Starting in 2010, after the emblematic Bitcoin Pizza Day, when a bitcoiner shelled out 10,000 bitcoin for two pizzas, the currency began to gain real market value.

At that moment, Bitcoin became worth 10 cents on the dollar, and this increase in value encouraged the development of more advanced and efficient mining methods at the time.

GPUs

GPUs, or Graphics Processing Units, are components capable of performing a variety of mathematical operations in parallel while running other applications, making them ideal for processing games, among other tasks.

Due to their efficient calculation performance, GPUs have been programmed to perform the specific calculations required in Bitcoin mining.

With this advancement, Bitcoin block production increased sixfold. GPUs only cost twice as much as CPUs, yet offered an excellent return.

However, with the continued adoption of Bitcoin, FPGAs emerged in 2011. These are pre-programmed circuits that were adapted to mine Bitcoin.

FGPAs

FPGAs, or Field-Programmable Gate Arrays, are types of board models that can be programmed to perform specific tasks. Compared to GPUs, they offer up to twice the efficiency in Bitcoin mining.

To operate effectively, FPGAs require a specific configuration of software and hardware. Their ability to be programmed for specific activities is what made them extremely efficient.

The emergence of ASICs

It was from previous advances that ASICs emerged in 2012. However, unlike other machines that were adapted for Bitcoin mining, ASICs (Application-Specific Integrated Circuits) were created exclusively for this purpose.

In 2013, the Chinese company Canaan launched the first set of mining-specific integrated circuits, ASICs.

ASIC miners have been designed in such a way that their software and hardware are solely for Bitcoin mining, meaning that these machines have no use for any other activity. This differs from GPUs, which can be used in regular computers for a variety of purposes, such as gaming.

Because they were optimized for this single task, ASICs are extremely efficient, and no other machine has yet been able to match this advancement.

Evolution of ASICs

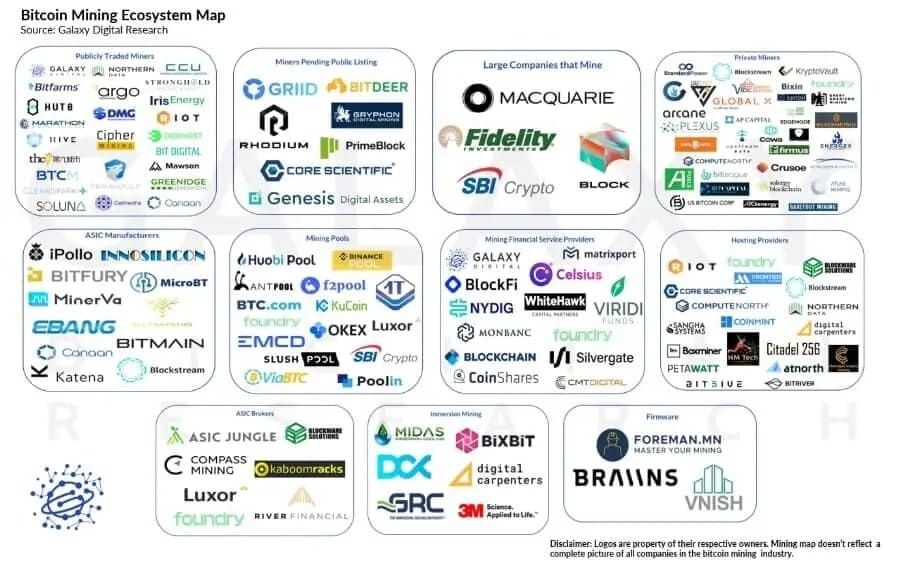

Canaan Creative ushered in the era of ASIC mining for Bitcoin, but it wasn’t long before other companies, like Bitmain, emerged and dominated the scene, becoming the largest ASIC manufacturer in the world.

As mining and Bitcoin gained prominence, several other companies and manufacturers emerged, bringing various innovations and improvements to the sector.

Currently, mining operates on an industrial scale, resulting in a vast and complex mining ecosystem, as can be seen in the photo below.

One of the main evolutions in ASIC miners to date has been the development of their chips and semiconductors. Initially, the chips measured 130 nm. Currently, the most advanced machines have chips of just 5 nm.

This miniaturization not only allows for a greater number of units per machine, increasing its efficiency but also improves cooling—a critical factor, considering that overheating can reduce performance or even cause failures.

In this context, one of the significant advances in mining was the emergence of immersive mining and water-cooled machines.

However, despite these advances, the average lifespan of an ASIC is still approximately 18 months, due to the accelerated pace of development and the constant need for more efficient hardware.

In addition to Bitmain, technology giants such as Intel are entering the ASIC market, indicating growing competition and a promising future for innovations in mining hardware.

What are the main ASIC models for Bitcoin?

ASICs are specifically designed to optimize Bitcoin mining, offering efficiency and processing power far beyond what CPUs or GPUs can provide.

This sector has seen rapid evolution, with several generations of ASICs offering constant improvements in energy efficiency, performance and cost-effectiveness.

Thus, the main ASIC models available on the market are:

- Antminer S19j PRO

- Bonanza Mine 2

- Antminer S19 XP Hydro

- Antminer S21

Would you like to explore each of them?!

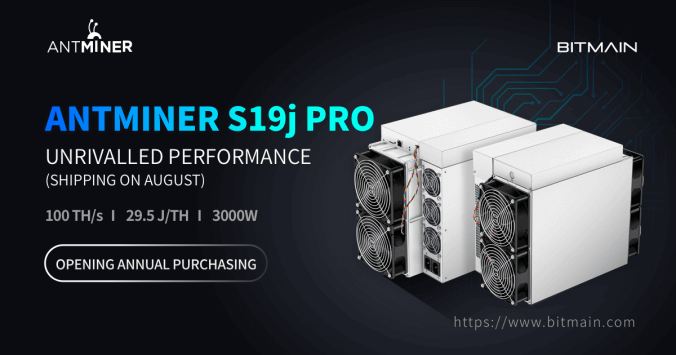

Antminer S19j PRO

In 2022, Bitmain set a new milestone in Bitcoin mining with the launch of the Antminer S19j Pro. This model quickly became one of the most efficient and widely used machines, known for its robust hash rate and remarkable energy efficiency.

The S19j Pro is ideal for miners seeking a balance between cost and performance, offering a consistent and reliable return on investment.

The choice of this model reflects a safe bet on a device proven to be effective and long-lasting in the competitive Bitcoin mining market.

Bonanza Mine 2

Shortly after the launch of the S19j Pro, Intel launched the Bonanza Mine 2, a 15% more efficient machine at half the price.

The Bonanza Mine 2 is a low-voltage, highly energy-efficient Bitcoin ASIC capable of delivering 40 terahashes per second (TH/s).

At the time, this launch not only diversified the ASIC market but also ushered in a new era of competition and innovation, highlighting Intel’s commitment to contributing to the advancement of Bitcoin mining.

Antminer S19 XP Hydro

Following the release of the S19j Pro, Bitmain continued to innovate by launching the Antminer S19 XP Hydro. This model not only raises the bar for energy efficiency but also introduces a water cooling system.

The S19 XP Hydro currently costs around $4,200, which is a significant investment.

However, its innovative design and operational efficiency make it an appealing option for serious miners aiming to maximize productivity and minimize operating costs, especially in hotter climates where cooling is a major concern.

Antminer S21

But all those models are now in the rearview because, in September 2023, Bitmain unveiled its latest model, the Antminer S21, capable of generating around 0.03 BTC per month.

Moreover, this machine also comes in a water-cooled version.

The S21 Hydro ASIC model from Bitmain is designed to mine the SHA-256 algorithm and delivers a maximum hash rate of 335 TH/s while using up to 5360W of power.

It’s currently on the market from $5,000 to $6,500.

What is the best Bitcoin miner?

Both the S19j Pro and the S21 Hydro are considered the top Bitcoin miners on the market.

However, for those looking to dive into Bitcoin mining professionally, it’s crucial to weigh the process’s costs in addition to the machine costs.

For serious miners aiming for top-notch performance and willing to pay more for higher returns, the S21 Hydro stands out as the best pick.

For those with a tighter budget but still in search of quality and efficiency, the S19j XP Pro is also a fantastic choice.

How much does an ASIC miner cost?

The cost of an ASIC miner can vary widely based on the model and its efficiency, with prices ranging from $1,000 to $6,000.

Thus, investing in an ASIC mining rig is a significant move for anyone considering entering the Bitcoin mining scene.

Here are the current prices for the main ASIC miners on the market:

- S19 Pro – U$1,300

- S19j Pro+ – U$1.400

- S19 XP – U$3.200

- S19 Pro Oct – U$1.800

- S19 XP Hyd – U$4.200

- S19 Pro+ Oct – U$1.800

- S21 – U$3,900

- S21 Oct – U$5.800

Is it worth mining Bitcoin with ASIC in your country?

It depends. Mining Bitcoin with ASIC is generally not worthwhile in areas with high electricity costs and where additional investment in infrastructure and maintenance is required.

As highlighted throughout this article, while it’s possible to purchase an ASIC and start mining at home, these machines consume a significant amount of electricity, leading to hefty electricity bills in the quest to mine a block.

Thus, even if you do earn some rewards, they may not be sufficient to cover the incurred expenses.

Simply buying an ASIC and expecting profits won’t cut it. The reality is stark: the competition is intense, and your machine requires a conducive environment and access to inexpensive energy.

You’ll likely need to invest not just in sound insulation and cooling systems but also in understanding how to conduct proper maintenance to ensure the longevity of your equipment.

Conclusion

Bitcoin ASIC miners were developed out of necessity, spurred by the evolution of the currency and its growing network.

As discussed, there are various models of these machines, evolving as Bitcoin and the market advance.

We’re currently witnessing the third generation of mining machines, and it’s likely that development will continue into the future. Therefore, we can anticipate the emergence of new models and methods to keep network efficiency and security at peak levels.

I hope this article has provided you with a deeper understanding of ASICs and Bitcoin mining.

Don’t forget to share it with a friend, and see you next time!

Share on your social networks:

One of the leading Bitcoin educators in Brazil and the founder of Area Bitcoin, one of the largest Bitcoin schools in the world. She has participated in Bitcoin and Lightning developer seminars by Chaincode (NY) and is a regular speaker at Bitcoin conferences around the world, including Adopting Bitcoin, Satsconf, Bitcoin Atlantis, Surfin Bitcoin, and more.

Did you like this article? Consider buying us a cup of coffee so that we can keep writing new content! ☕